Spanish property prices 2017: Where are we in the cycle?

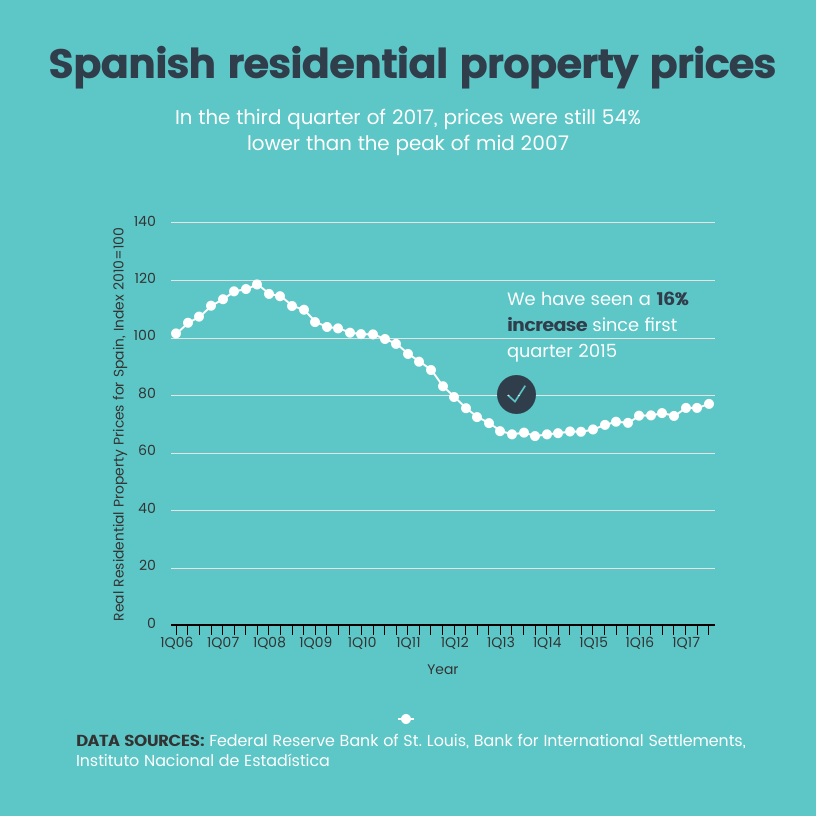

After bottoming in the fourth quarter of 2013, data from the third quarter of 2017 shows that Spanish property prices have increased 16.9% since the low of 4Q13. It’s no cryptocurrency bubble, but some fear that prices may be peaking.

In this article we use historical data, and basic economics, to demonstrate that there is still ample room for price appreciation. We also discuss the most attractive property market and how to get involved.

Historical Spanish property price data

A picture is often worth a thousand words and this is no exception. As you can see in the following historical price chart, even after the recent run-up, prices are still 54% off their peaks of mid-2007.

Spanish property prices are on the upswing but as you can see, they still have a long way to go before reaching historical levels.

Can we expect Spanish property prices to achieve past highs?

The high prices attained in 2007 were part of a global run-up in real estate prices. This was due to a number of factors, such as easy credit and the development of new financial products. Many argue that these factors will not allow global real estate prices to return to their pre-crisis levels.

This may be true in countries such as the US that experienced over-lending, and outright fraud on the behalf of many mortgage brokers, but the Spanish market was a bit different. Spanish banks were more cautious granting mortgages, and did not securitize loans at the pace that US and UK banks did. The Spanish market was driven more by traditional fundamentals, such as demographic changes and GDP.

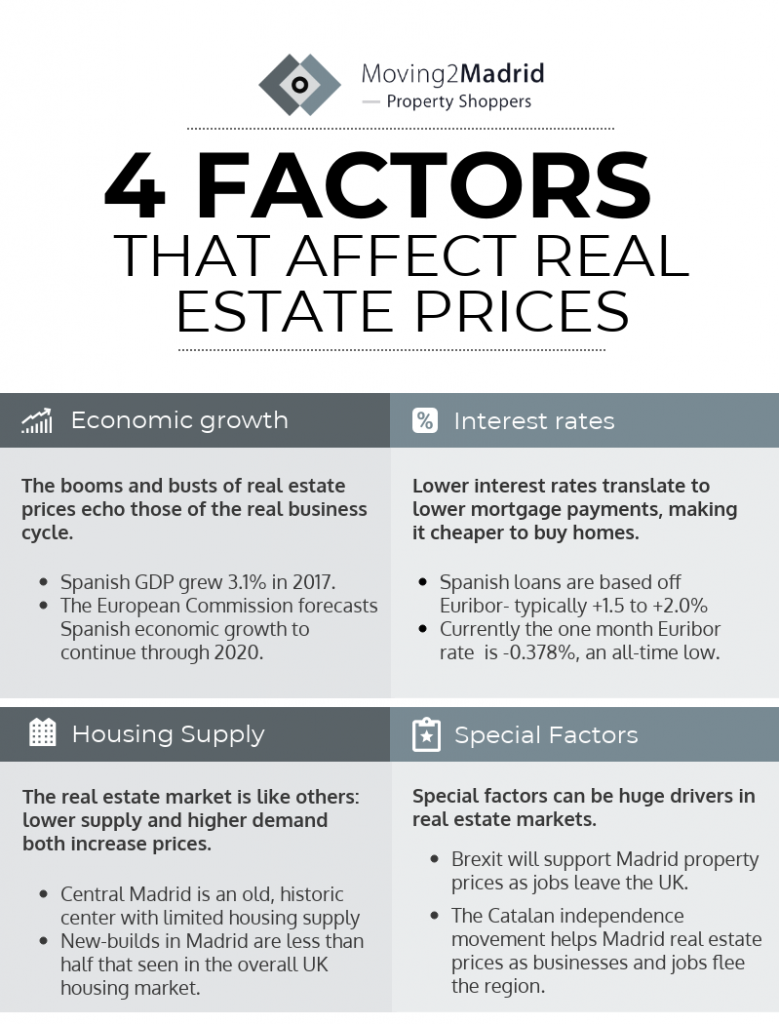

Factors that affect real estate prices

Economic Growth

In the late 1990’s and early 2000’s Spain experienced two things: sharply lower interest rates when it abandoned the peseta and joined the Eurozone and unheralded economic growth. Both of these factors fueled an enormous property bubble. Between 1996 and 2007 Spanish property prices tripled- comparable to price rises seen in the UK and more than the price increase seen in the US as a whole.

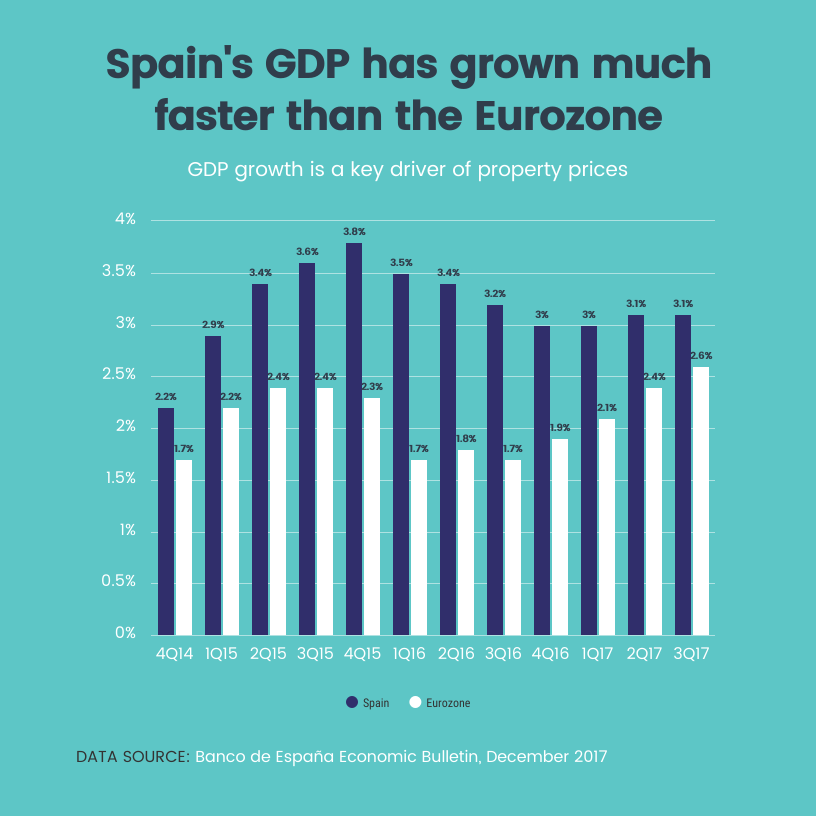

When the world financial crisis hit, the bubble burst. Construction dried up, which put many out of work. People could no longer service their mortgages and the banks piled bad debts on their balance sheets. The country went into a deep recession. This forced the government to make structural changes, streamline the bureaucracy and force banks to clean up their books. The economic recovery began in 2014 and has been impressive. Earlier this year, Spanish GDP surpassed its pre-crisis level. Today, Spain is one of the fastest growing economies in Europe.

Not only has the Spanish economy enjoyed strong growth, but the European Commission forecasts it to continue through 2020

The IMF raised its initial forecast, and is now expecting the Spanish economy to achieve 3.1% economic growth in 2017. The European Commission forecasts economic growth to continue through 2020, while unemployment and interest rates continue to decline.

Actual GDP growth could easily surpass these projections if momentum from past reforms accelerates. In recent years Spain has restructured its banking sector and made changes to its labor laws. These changes, combined with strong growth in goods and services, will continue to drive GDP.

Madrid, in particular, will continue to see strong economic activity. In addition to the above factors, the city has made a number of improvements to attract foreign investment (FDI). Over half of all FDI in Spain is in the Community of Madrid, and the money continues to flow in. FDI is a strong driver of economic growth.

Interest rates

Spanish mortgages are based upon Euribor, the Central Bank of Europe’s rate. Currently the one month Euribor rate (most mortgages are based off the one or three month rate) is -0.378%. Although the rate changes daily, they are at all-time lows. Currently, one can expect to receive a rate of Euribor + 1.5% to Euribor +2.0%. Going forward, these extremely low interest rates will provide an excellent catalyst for Spanish property prices.

Housing supply

The Spanish property market was one of the hardest hit by the 2008 financial crisis. This is because when housing prices started to rise, they fueled a large amount of new construction. This was particularly true in the large suburbs surrounding Madrid. In short, too many homes were built so there was an over-supply of housing. When prices started to fall, the over-supply caused prices to plummet. Prices are still slow to recover in these outer areas.

Central Madrid is very different. An old historic city, it very difficult to build new places. There are strong zoning laws and very little vacant space. This can be seen in the new-build statistics of 2017. In Salamanca, the most sought after, and active, real estate neighborhood in Madrid, new-builds accounted for 11.9% of the available housing stock. This number was 11.3% in Chamberí and only 2.2% in El Viso- a neighborhood popular with foreign families. Contrast that with the UK, where housing stock has increased 20% or more year on year. Even with these numbers, the UK Government still wants a million more homes put up by 2020.

Madrid is an elegant, historic city. Like many old cities, the apartment stock is limited.

Special factors- Brexit and Cataluña

How will Brexit affect Spanish real estate prices?

Many UK citizens are worried about losing their right to work in the EU. We are receiving a number of requests for information about Spain’s Golden Visa program from UK citizens.

Spain’s Golden Visa was created to encourage non EU citizens to purchase homes in Spain. It is arguably the most attractive in Europe, only requiring a purchase of 500,000€ to obtain Spanish residency (including permission to work). Click here to learn about the costs and benefits of the different European Golden Visa programs.

We predict that in the post-Brexit world, we will see an increasing number of UK citizens purchase property in Spain, particularly those that work in the City of London. This will allow them to work in cities such as Frankfurt, where much of London’s banking industry is moving.

What are the economic effects of the Catalan crisis?

The situation in Cataluña strongly benefits Madrid. Over 1,800 businesses, even large banks such as Caixa and Sabadell, have left the region. Many of these are moving to the capital. This will drive economic growth in the City of Madrid and bolster the real estate market. To learn more about the situation in Cataluña, read Why Catalan independence doesn’t affect the Madrid property market.

Conclusion: Is it still a good time to buy Spanish property?

In short, yes! However, it is location dependent. Given the crisis in Cataluña, we do not recommend buying real estate in Barcelona or its surrounding areas. However, we do recommend buying real estate in Madrid.

The more aggressive money (Goldman Sachs, Blackrock) got in the game early. They started purchasing large portfolios of Madrid real estate in 2014. At that time, prices were at their absolute low but there was still a lot of risk. No one knew if prices had indeed troughed, if crucial reforms would be made and how long it would take prices to recover. Prices remained stagnant in 2014.

Two years later, the dynamics have remarkably improved. However, Spanish property prices are still 54% less than 2007 highs. Please keep in mind that these numbers are for all of Spain. Given the crisis in Cataluña, the limited housing stock in Madrid and changes made by the Community of Madrid to stimulate foreign investment, we believe that prices in Madrid will easily surpass 2007 highs.

The time is now for more risk concious investors to purchase Madrid property, and take advantage of appreciating prices. Arrange a FREE CONSULTATION TODAY to learn how to take advantage of this excellent opportunity.

Posted on 31 December, 2017 by Pierre-Alban Waters in Invest, New? Start Here

[…] prices have increased, they still, on average, have a long way to go before attaining pre-crisis levels. Moreover, due to structural reforms, the strength of the Spanish economy and external factors like […]

[…] important to purchase sooner rather than later. Book a free call TODAY to learn more about current Madrid pricing trends and explore your […]

[…] learn more about the opportunities for price appreciation in the Spanish real estate market, read Spanish property prices 2017: Where are we in the cycle? If you’d like to learn more about how to invest in Madrid real estate, arrange a FREE […]