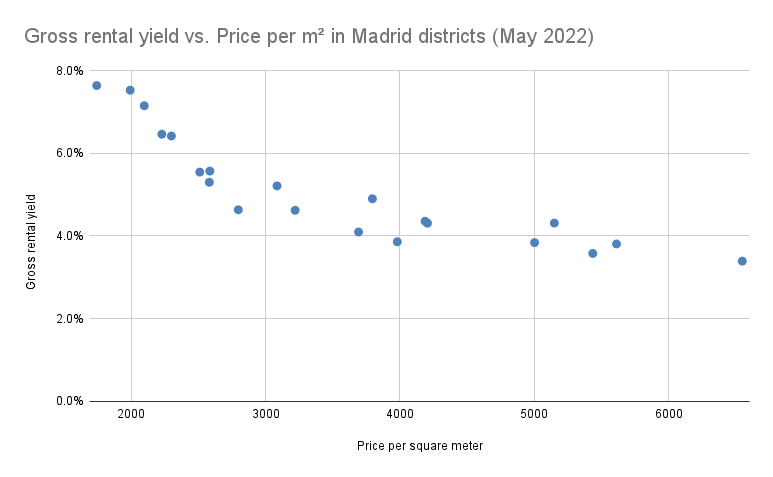

Do cheaper properties provide higher return?

Looking at sale and rent prices across neighborhoods in Madrid, it seems cheaper properties provide higher return.

In May 2022 the Center’s sale prices average 5,149€ per square meter while rent prices average 18.5€ per square meter per month. A 4.3% gross rental yield per year. In Tetuan sale prices average 3,795€ per square meter and rent prices average 15.5€ per square meter per month. A 4.9% gross rental yield per year. In Puente de Vallecas sale prices average 1,992€ per square meter and rent prices average 12.5€ per square meter per month. A 7.5% gross rental yield per year.

While cheaper properties tend to provide a higher gross yield, it does not tell the full story. You should treat your property investment as a business, gross revenue is only one part of the picture. You need to take other factor into consideration such as:

- Acquisition and operation costs

- Market cycle and trends

- Property management

We used idealista report to gather the price data for this article.

Acquisition and operation cost

Acquisition cost

As you purchase a property you should expect a series of acquisition costs on top of the purchase price. You can find the details on these in our article The real cost of buying an apartment in Madrid.

While taxes are percentage based, notaries, accountants, deeds managers and in some cases lawyers will apply a fixed rate. If like most of our clients you live abroad, travel costs will enter into the equation as well. They may seem small in comparison to the purchase price, most notaries will charge you 800€ for the purchase. However, they quickly add up, the lower the purchase price, the more impactful they will be.

Operation cost

Once your purchase is complete and you start renting the apartment other expenses need to be accounted for. Whether you buy a 60 square meter apartment in Tetuan or in the Center, the cost is not going to be lower because the price of the apartment is cheaper. Repairing the building roof, changing the boiler or painting the apartment will be the same. For a 60 square meter apartment in Madrid, building community averages 60€ per month. The apartment maintenance cost will average 50€ per month. Often time to community cost will be increased to take care of unforeseen expenses like repairing the roof.

Another thing to consider would be refurbishment costs. Fully refurbishing a 60 square meter apartment in Madrid would cost around 50.000€ regardless of the neighborhood it is located in. To know more about refurbishment in Madrid please refer to our article: How much does property refurbishment cost in Madrid?

Market cycle and trend

The future is never clear

You can make a good guess at it but there is no way to know where the market will be in five years from now. However, expecting prices to remain where they are is not very realistic either. Both rent and sale prices are going up and down according to the economic conditions we are in. For instance, if unemployment increases it will have a negative effect on prices.

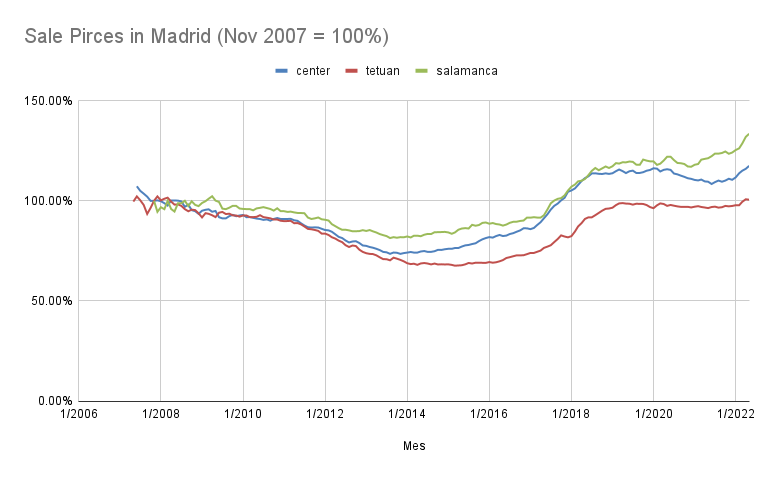

One of the best tools we have to get an idea of what may happen in the future is to look at what happened in the past. Based on that, one observation you can make is that Madrid districts with higher prices per square meter are also more stable. They tend to fall later and rise sooner. It makes sense, people who live in more consolidated neighborhoods tend to be wealthier whether they own or rent a property there. They are less likely to be affected by an economic downturn and benefit more from a growing economy.

What happened in the past

If you bought a property in Salamanca in November 2007 the worst case scenario would have been to sell it in August 2013 at a 18.6% discount. In the Center, the worst case scenario would have been to sell it in November 2013 at a 26.5% discount. In Tetuan, the worst case scenario would have been to sell it in March 2015 at a 33.8% discount.

Your rental return too would have been affected by these up and down. In May 2009 rental prices averaged 16.9€, 16€, and 14.6€ per square meter per month in Salamanca, Center, and Tetuan respectively. Five years later in May 2014, the average rent price per square meter per month was 13.6€ in Salamanca, 13.4€ in Center, and 11.2€ in Tetuan.

In May 2009 you were expecting a yearly gross rental yield of 4.1% in Salamanca, 4.6% in the Center, and 5% in Tetuan. In reality, after 13 years in May 2022 your gross rental yield would have been 3.22%, 3.70%, and 3.73% per year in Salamanca, Center, and Tetuan respectively. By then the price of your property would have increased by 33.3% in Salamanca, 23.7% in the center, and 9.5% in Tetuan. Putting rental return and capital appreciation together your total gross yield would have been 6.89%, 6.39%, and 4.87% per year in Salamanca, Center, and Tetuan respectively.

Management

At the end of the day prices are higher in the Center and in Salamanca because people find it more attractive to live in these neighborhoods. You will find nicer restaurants, more cultural centers, and shopping areas at your doorstep as well as better access to transport. Higher prices will attract tenants with higher purchasing power who are less likely to default on their rent.

You will have more options when looking for a company to manage your apartment. They will be more motivated to find you a tenant and help you out when an incident comes since their comision is based on the rental price. It will also be easier to switch between different types of rentals: yearly, monthly, or daily to optimize return.

Conclusion

While at first glance, a cheaper property seems to provide a higher return, we have seen throughout this article that to make an educated decision you need to take other factors into account. What are the costs involved? What are the strengths and weaknesses of the asset? How easy will it be to find a tenant? Generally speaking higher return comes at the expense of higher risk.

At Moving2Madrid we want to make it as easy for foreign individuals to invest in Madrid as it is for locals and institutional investors alike. If you need help making the most of your budget in Madrid, book a free consultation with us now.

Posted on 30 June, 2022 by Brian Mosbeux in Return on investment - Invest, New? Start Here

Leave a Reply