How the new Spanish mortgage laws affect Madrid property owners

On June 17, 2019, Spain introduced long awaited changes to existing Spanish mortgage laws. This was done to bring them in-line with an EU Directive to provide increased consumer protection, post the 2008 financial crisis. Read this article to learn how the new changes benefit existing property owners.

It is much harder for a bank to repossess your home

Post the 2008 crisis, new laws were enacted to make it easier for banks to evict homeowners for non-payment of monthly mortgage obligations. After the crisis, banks could start repossession proceedings if you missed a single mortgage payment.

A few years later they amended these laws and allowed for three months of non-payment before they started evictions proceedings.

Now, consumers have much more protection. New Spanish mortgage laws allow homeowners to be twelve months in arrears before lenders can begin repossession proceedings. Specifically:

- In the first half of the mortgage term, lenders cannot repossess a property until the borrower is 12 months late in their mortgage payments, or the total amount of their arrears is more than 3% of the total capital loaned.

- In the second half of the mortgage term, lenders cannot repossess a property until the borrower is 15 months late in their mortgage payments, or the total amount of their arrears is more than 7% of the total capital loaned.

- Late payment fees can be no more than 3% of the amount in arrears. Before the new mortgage laws, late payments fees were up to 12%.

It is much cheaper to convert a floating rate mortgage to a fixed rate mortgage

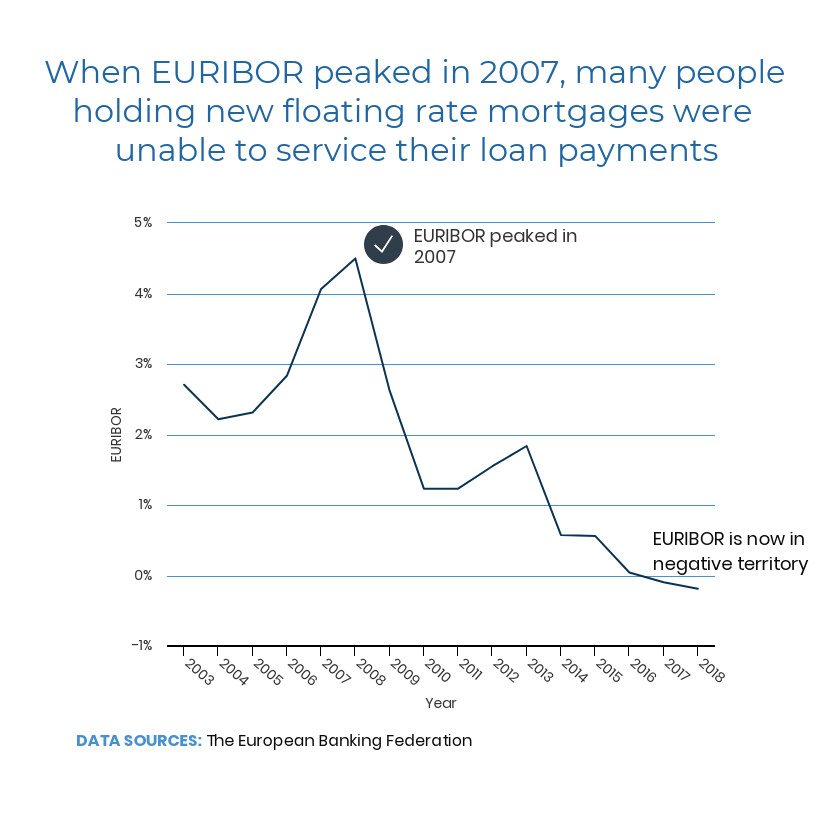

Floating rate mortgages are risky for borrowers. Many people with floating rate mortgages defaulted in the 2008 crisis because their interest rates increased substantially and they unable to service their monthly payments.

Much of the problem was caused because bank salespeople enticed people to buy products they didn’t understand. In 2003 and 2004, when mortgage origination reached peak levels, they offered mortgages with interest payments which uneducated borrowers snapped up when rates were relatively low. When the rates increased in 2007 and 2008, they were unable to pay their fees and defaulted.

Spanish Mortgage Approvals 2003-2019

Data Source: tradingeconomics.com

With interest rates in negative territory, and new Spanish mortgage laws favorable to consumers, now is an excellent time to get a Spanish mortgage. Arrange a FREE CONSULTATION TODAY to learn how to minimize your Spanish mortgage fees

New Spanish mortgage laws require banks to provide potential floating rate mortgage clients with details on what their mortgage payments will be under different interest rate scenarios.

Homeowners with existing mortgages are retroactively offered protection under the new Spanish mortgage laws. If you have an existing floating rate mortgage, you can convert it to a fixed rate mortgage. If you convert your floating rate mortgage to a fixed rate within the first three months of its term, the maximum fee you will incur is 0.15%. If you convert it after the first three years of its term, you will not have to pay a conversion fee. However, in both scenarios, you will be responsible for notary and Land Registry fees.

Spanish mortgage laws allow borrowers to convert foreign currency denominated mortgages into euros

This is a little tricky and could be a double edged sword for expat borrowers.

Foreign currency mortgages can be converted to euros

The new law stipulates that mortgages issued to expats from non-EU countries can convert their mortgages to euros under the following two conditions:

- If the currency in which the borrower receives most of their income, in which the bulk of their assets is denominated,is not the euro.

- If they move to another country to work, and that country does not use the euro.

Although this seems very generous to expats, some fear that the new Spanish mortgage laws will prevent banks from issuing mortgages to non EU citizens.

Not retroactive for everyone

Unlike the above changes that apply retroactively to all existing mortgage owners, this change does not apply to everyone. It applies to expats who have an existing mortgage denominated in their local currency (not euros).

According to legal experts, this part of the new Spanish mortgage laws is rather unclear. Sources from major banks have stated they are waiting further clarification from the Bank of Spain or the Ministry of Economics on this provision. This blog article will be updated when we learn more so keep checking back!

A new institution is being established to protect borrowers

The Bank of Spain is creating a new, consumer friendly entity. They will be able to answer questions for consumers, accept and process all mortgage related complaints.

Conclusion

The new Spanish mortgage laws are very good news for homeowners with existing mortgages. If you need help understanding how the new laws affect you, don’t hesitate to contact us with any questions.

Posted on 29 June, 2019 by Admin in Mortgage, New? Start Here

[…] biggest news is the changes to the mortgage laws. In June, 2019 the Spanish Government rolled out its long anticipated changes to the mortgage laws, […]