Case study: Short vs long term rental income

Read this article to see an actual case study that compares differences in short vs long term rental income in Madrid.

The Case Study

This article uses actual data from a property located in the neighborhood of Lavapiés, in Madrid.

Lavapiés lies between two main plazas: Tirso de Molina (above) and Lavapiés

The property is located at Calle Meson de Paredes, 64. It is a two bedroom, one bath apartment. The purchase price was 205,000€ and the closing costs were 32,179€.

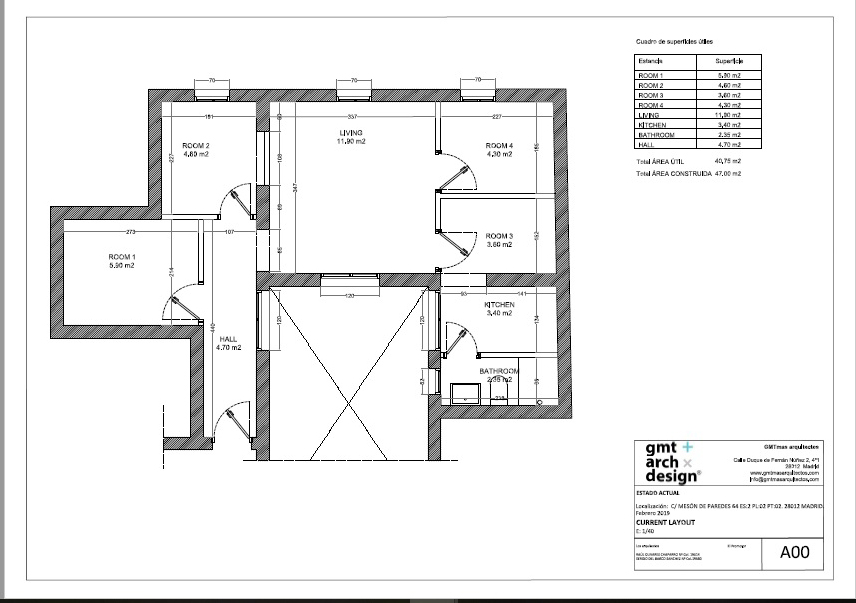

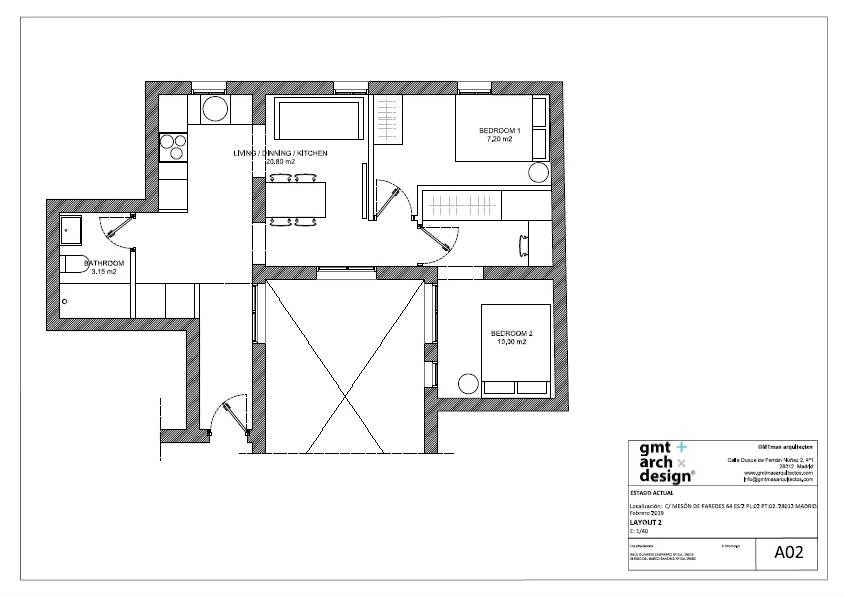

The apartment is 53 square meters and originally had four very small bedrooms. The owners decided to completely renovate the apartment. They moved the kitchen and bathroom to the front of the apartment and created two large bedrooms, as opposed to the four small ones. This allows the property to fetch a higher rental price in both the short and long term rental markets.

- This was the floor plan before the renovation

- This is the floor plan after the renovation

The owner spent 46,000€ on this renovation, so the total property value (purchase price + closing costs + renovation costs) is 283,179€ .

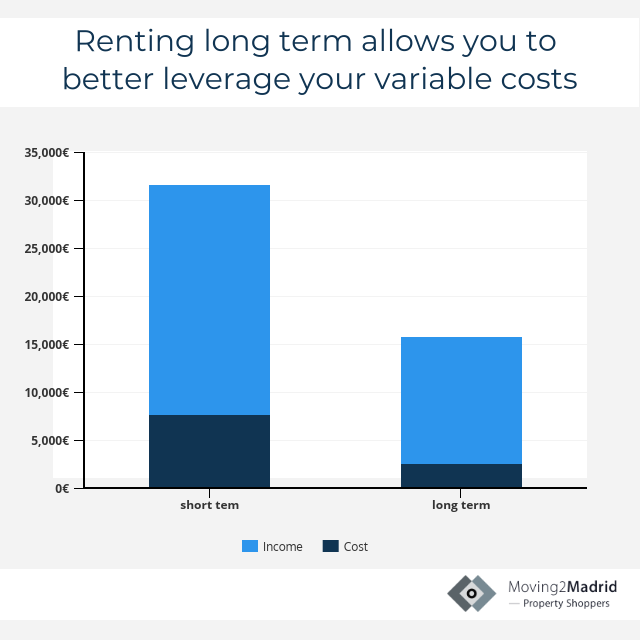

We will look at two possible return scenarios. First, if the apartment is rented on the short term market (less than one month at a time). Second, if the apartment is rented long term (a year or more). Both cases will examine net rental yields.

Short term rental income

If listed on Airbnb, the apartment fetches 93€ per day. This averages 24,000€ revenue per year, assuming a reasonable vacancy rate. Renting the apartment on the short term market carries the following costs:

Property management fee (including IVA): 4,800€

Gas and power: 1,088€

Internet: 540€

Community fees: 780€

Property and urban waste tax: 300€

House insurance: 200€

TOTAL YEARLY COSTS: 7,708€

Subtracting these from the annual rental revenue of 24,000€ yields an annual rental income of 16,292€, thus the short term net rental yield=5.8%:

Net rental yield = (16,292/283,179)*100=5.8%

Long term rental income

If rented long term, the apartment can earn 1,100€ per month, which translates to 13,200€ yearly revenue. Renting the apartment long term carries the following costs:

Property management fee (including IVA): 1,320€

Gas and power: 0€

Internet: 0€

Community fees: 780€

Property and urban waste tax: 300€

House insurance: 200€

TOTAL YEARLY COSTS: 2,600€

Subtracting these from the annual rental revenue of 13,200€ yields an annual rental income of 10,600€, thus the short term net rental yield=3.7%:

Net rental yield = (10,600/283,179)*100=3.7%

Conclusion

Many people prefer to rent their apartment long term because they think it is easier and leads to less wear and tear on the apartment. However, this leaves a lot of money on the table because short term vacation rentals fetch much higher returns. In our case study, the short term rental yield on the apartment at Meson de Paredes, 64 is 5.8%, compared with a 3.7% rental yield when rented long term. This takes into account the fee associated with hiring a short term property management company to maintain the property, manage the guests and ensure the property is rented at the best possible daily rate with minimum vacancy.

Do you want to find a property to rent short term? If so, CONTACT US TODAY and arrange a FREE CONSULTATION.

Posted on 30 May, 2019 by Admin in Return on investment, New? Start Here

Leave a Reply