Why Madrid is the best European city for Airbnb investment

Airbnb is huge- keep reading this article to understand how truly massive it has become. Like any smart property investor, you want to find a way to capitalize on this opportunity. But like any opportunity, you want to be careful because some of the markets are already over saturated. In this article, we will explain the Airbnb phenomenon, criteria a city should meet for Airbnb investment and why Madrid is the best European city for Airbnb investment.

This is the Plaza Mayor during the holidays, Madrid’s main square. Madrid is currently the best European city for Airbnb investment.

The Airbnb play

You’ve heard of Airbnb, just like everyone else. But do you realize how truly massive the company has become? To put things in perspective: After it received its latest $1 billion injection of capital in spring, 2017, Airbnb is now profitable and valued at $31 billion. This is more than the market capitalization* of the two largest hotel chains, Hilton International (market cap of $20.4 billion) and Hyatt (market cap of $7.5 billion) combined. Add in the market cap of the prestigious Mandarin Oriental chain ($2.6 billion) and the three combined equals $30.5 billion- still half a billion dollars less than Airbnb. Get the idea?

Do you know what Airbnb’s biggest market is?

Airbnb operates in more than 65,000 cities across 191 countries. Its biggest market? Europe. Airbnb not only knows this, but is actively working to build this market. Last June it launched a new “Community Tourism Program” with the aim of investing in projects “to help preserve and boost the best of local customs, traditions and landmarks that make communities unique.” Airbnb estimates this will create €340 billion of economic output by 2020 and that it will support an estimated 1 million jobs across the region by that year.

Does this mean every European city is good for Airbnb investment?

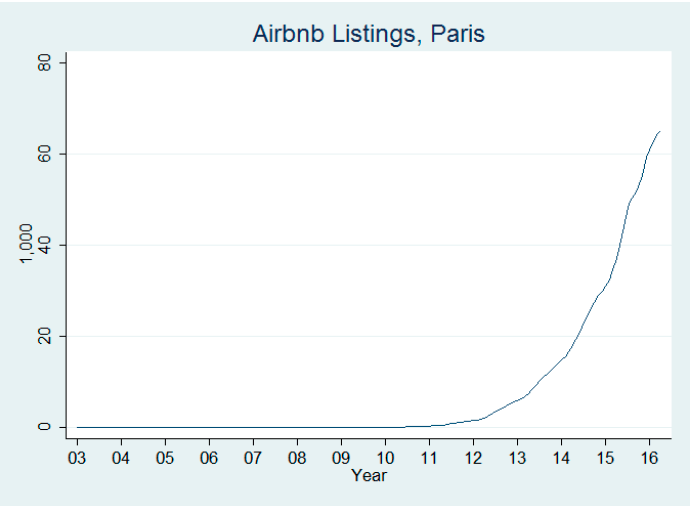

No- the Airbnb play is not a new opportunity. In many cities it is very developed, with supply out-stripping demand. Take Paris, for example:

Paris was early to the game and Airbnb listing have grown sharply since 2011. (Data source: Toulouse School of Economics, 2016)

Currently, Paris has the largest Airbnb capacity of any city in the world. This, combined with falling levels of tourism and increasingly high property prices, means that Paris has become one of the worst cities for Airbnb investment.

International property investment requires on the ground expertise. If you want to avoid investment pitfalls like the pricey Parisian market, contact M2M for a free consult.

What are criteria for a good city for Airbnb investment?

According to Forbes and Airdna,

“There is a direct correlation between the number of Airbnb rentals in a city and the profitability of the average rental. [Moreover], Airbnb rentals are most profitable in highly regulated cities. The lack of lodging supply allows Airbnb hosts to charge rates equal to or even above hotels.”

We would argue that two other factors are also of utmost importance: financial criteria and a city’s existing hotel stock.

Low Airbnb capacity

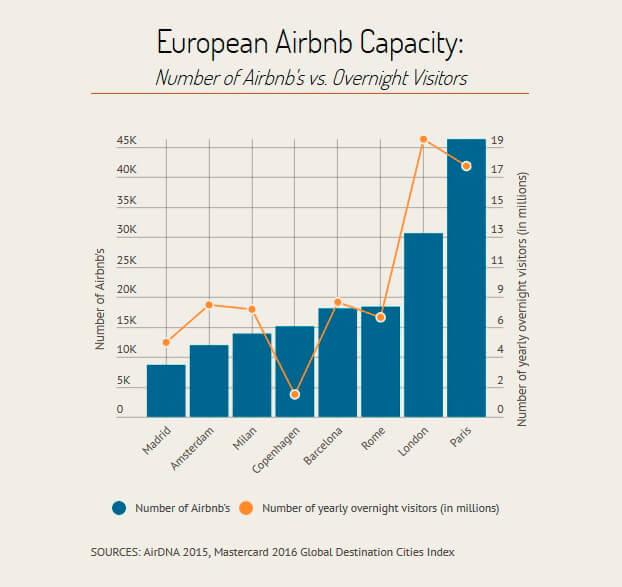

This is probably the most important factor. However, it must be looked at in relation to a city’s tourism numbers. The key is to look at a city’s existing Airbnb capacity vs. its number of overnight visitors. The lower this ratio, the less Airbnb capacity the city has.

For example, the city of Copenhagen has almost twice the number of registered Airbnb’s as Madrid. However, its number of yearly overnight visitors is less than a third of Madrid’s, meaning the city has relatively ample capacity.

Madrid is one of the major European cities that lack Airbnb capacity, meaning it is a good place to consider investing. As you can see in the above chart, Amsterdam, London and Milan also lack capacity.

Keep reading to learn why these cities should be ruled out. Plus, you will learn the secret play that makes Madrid the best European city for Airbnb investment . . .

The quantity and quality of a city’s existing hotel stock

Airbnb customers have other options. The most compelling is to stay in a traditional hotel room.

When Airbnb started, it initially found traction in the lower end of the market. People with expensive apartments in cities like New York and Paris would rent spare rooms, or their entire apartments when they went on vacation, to people that couldn’t afford to pay $500-$1200 per night for a hotel room.

This has evolved in recent years. People are now staying in Airbnb’s so they can get a more local experience, or a more personalized experience. They may also prefer to stay in a private residence when the city’s hotel capacity lacks amenities and/or charm. Remember:

“The lack of lodging supply allows Airbnb hosts to charge rates equal to or even above hotels.”

Madrid has a decent number of hotel rooms, but it has a strikingly low capacity of boutique and high end hotels, especially when compared with cities like London and Frankfurt. Many major players, such as Mandarin Oriental, Four Seasons, St. Regis, The Peninsula and W Hotels do not have a presence in the city. In fact, of all major European capital cities, only Milan has a lower supply of boutique and luxury hotels. Higher end visitors, that are used to these luxury brands, are increasingly seeking out luxury Airbnb properties when the local hotel stock is wanting.

Strong financial criteria

Yes, capacity is important. But you still need to make money, ideally in both the short and long terms. The key is to buy low, sell high, and maximize rental returns in the process.

Buy low, sell high

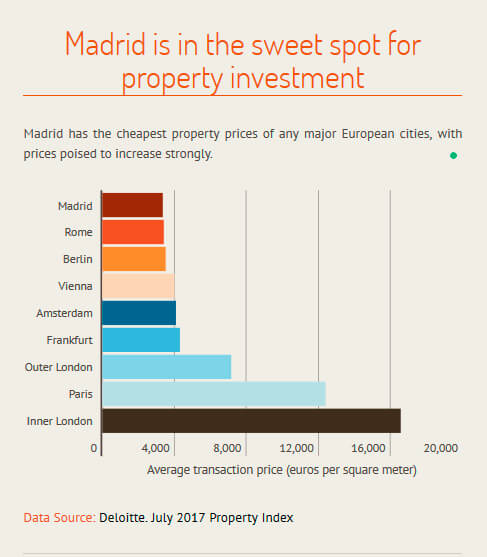

Cheap property prices allow for long term capital appreciation on your rental property. They also allow for for Airbnb investment by those with more moderate budgets.

There are two ways to make money on your Airbnb investment property. Long term capital appreciation and rental income. Madrid has the lowest entry point of any major European city for real estate investment. This, coupled with the fact that prices are expected to increase 19% over the next four years, gives it excellent potential for long term capital appreciation. This criteria is why we rule out London- although it does have a relatively low capacity of Airbnb’s, it is extremely expensive and prices are forecast to depreciate over the next few years due to Brexit. Amsterdam is cheaper than London or Paris, but still much more expensive than other cities.

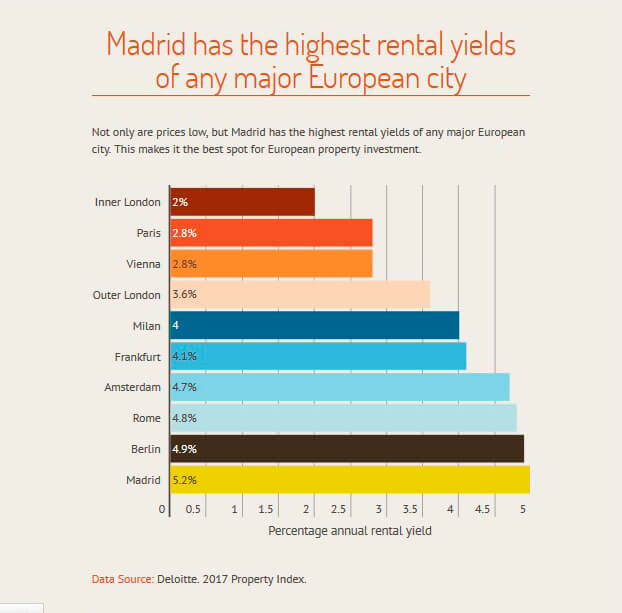

Maximize rental returns

On average, rental yields in Madrid are the highest among major European cities, and some of the highest in the world. This is a compelling reason to buy any investment property in the city and let it out. Not only will you make money from capital appreciation, but you will earn a materially higher return in Madrid on your rental income. Neither London, Milan nor Amsterdam can come close to this return and they all have higher entry points.

Numbers don’t lie. Low capacity, a cheap entry-point and high rental yields make Madrid the perfect city for Airbnb investment.

What you need to know about Airbnb regulation

Most investors are initially scared of regulation, and we initially were too. In the Airbnb world, regulation is turning out to be a good thing. Remember:

“Airbnb rentals are most profitable in highly regulated cities.”

Some cities, such as Barcelona and Berlin, have started regulating Airbnb properties. This has restricted Airbnb capacity in these cities, which has led to increased returns for participants that get in early and/or adhere to the cities’ requirements. Click here to learn more about proposed Airbnb regulation across Europe.

Spanish Airbnb regulation

Madrid has recently followed suit and introduced new Airbnb regulation. However, the Regional Premier Cristina Cifuentes clearly states that “The situation in Madrid is not comparable to that of Barcelona.”

Barcelona regulation

The Barcelona property market initially shared many of the features of Madrid (low entry prices, suboptimal hotels and high numbers of international visitors). Because of this, Airbnb capacity skyrocketed. At one point, 8% of all properties in the center of Barcelona were listed on Airbnb. Many Barcelona residents have become extremely xenophobic. In response, the city decided to stop granting new licenses for holiday rentals in the city center. Now, if you want to rent your property for more than a month in the city of Barcelona you must have an operating license. People that don’t respect this are fined.

New Madrid regulation

The Town Hall of Madrid is taking a much more balanced approach. There are two main reasons they want to regulate Airbnb. First, hotels are losing business to Airbnb, while still having to jump through all the legal hoops private homeowners haven’t had to deal with. They also have to pay the appropriate taxes on hotel stays, whereas many private homeownes do not.

Second, many residents of Central Madrid feel they are being priced out of the city center. Rents have increased 15% in the past year. Many residents blame this on people purchasing, and letting, investment properties.

The City has come up with a variety of solutions to the problem:

- Introduce Suitability Certificates. These are required for anyone renting their property more than three months per year. In the past this was left up to individual neighborhoods. Now the City of Madrid has taken charge. Suitability Certificates will be granted on a neighborhood basis to prevent over crowding.

- Give condominium homeowners groups more authority. This will be similar to what happens in New York City. Homeowners’ associations will be able to ban condo owners from renting out their properties short-term. This sounds daunting but in New York City, it has very little effect unless you live in a building with a lot of celebrities.

- Owners must do things to provide their renters a high-quality experience. They must take out insurance, provide consumer complaint forms, heat, emergency numbers and evacuation procedures.

- Home-sharing sites like Airbnb must send information about people listing properties to the Spanish tax authorities.

What the new Airbnb regulation means for property investors

When Barcelona stopped approving new Airbnb licenses, property owners with the proper licenses discovered they were sitting on a goldmine. We estimate that after the regulation, apartments in Barcelona with proper licenses have gained 80k-100k€ in value. Remember, it’s all about supply and demand.

Although the Madrid regulation is much more balanced, property owners in central neighborhoods popular with tourists stand to benefit greatly. This is a unique Airbnb investment opportunity. The new legislation won’t begin to go into effect until July. If you can move quickly, purchase property and obtain a Suitablity Certificate in a highly desired neighborhood, your property stands to appreciate considerably if the City limits granting of certificates. To learn more about how to take advantage of this, read How to capitalize on the future of Airbnb investment in Madid. Or book an appointment to speak with a M2M representative about leveraging this unique opportunity.

In the Airbnb world, regulation is turning out to be a good thing because Airbnb rentals are most profitable in highly regulated cities. Madrid is poised for more regulation, which will lead to increased returns for all legitimate Airbnb’s.

Conclusion

There are a number of criteria that should be considered when choosing a city for your Airbnb investment. First, find one with low Airbnb capacity. Then ask the following questions:

- Does the city have good hotel capacity? Meaning, are there a lot of hotels and are they of good quality? You want to choose cities with low existing hotel capacity and/or cities with low quality hotels.

- Is there room for capital appreciation? You want a city with low property prices, poised to increase strongly.

- Are rental returns high? You want a city with high rental returns.

Madrid meets all of the above criteria better than any other major European city, making it the best European city for Airbnb investment.

The icing on the cake? The City of Madrid plans to regulate Airbnb’s. This will limit the capacity and further increase returns for those that own and operate legal Airbnb’s. The key it to take advantage of this opportunity sooner rather than later- there is definitely a first mover advantage in this situation. CALL US TODAY to learn how to take advantage of it!

*All market valuations as of September 13, 2017

Posted on 14 September, 2017 by Pierre-Alban Waters in Invest - How to invest, New? Start Here

[…] Madrid is still in the “sweet spot” for short-term, Airbnb property rental, this is true for mid-range priced properties. Long term property rental is becoming more appealing […]

[…] Airbnb legislation in Madrid continues to be in the news. The Government said it would start enforcing the new legislation, which requires all tourist rentals to be registered with the city, later this year. There are many people that think the legislation will not be enforced. Current events, such as the regional goverment’s unwillingness to meet the demands of striking taxi drivers and curb Uber’s actions, signals that they are quite rational with respect to new sharing economy businesses. Madrid’s conservative regional chief, Ángel Garrido, went on record saying that Barcelona and Catalonia are “heading to the Middle Ages.” Read this article to learn why Madrid is the best city for Airbnb investment. […]

[…] much milder Airbnb regulation than Barcelona, there is always the possibility they will follow Barcelona’s lead and stop issuing new short-term property rental licenses. We do not think this is likely as recent […]

[…] you planning on buying a property in one of these Madrid neighborhoods and listing it on Airbnb? If so, you should know that the laws are scheduled to change in 2Q19. At that time, people renting […]

[…] advice, including the procurement of Airbnb licenses. Read: Why Madrid is the best European city for Airbnb investment to learn more about Airbnb licenses in […]

[…] is currently the best European city for Airbnb investment. If you wan to earn additional income from investing in Madrid property, but don’t want the […]

[…] The City of Madrid initiates new Airbnb regulation. Contrary to initial assumptions, intelligent regulation has benefited Airbnb property owners. This new, mild regulation arguably makes Madrid the best city for Airbnb investment. […]