Why long term property rental is becoming more appealing in Madrid

Although Madrid is still in the “sweet spot” for short-term property rental, this is only true for mid-range priced properties. Long term property rental is becoming more appealing in Madrid for cheaper and premium apartments. Read this article to learn why.

A note about purchase prices

In this article, the purchase price numbers we give are “all-in.” Meaning, they include all closing costs and refurbishment costs. For Moving2Madrid clients, closing costs typically amount to 10.5-11.5% of the final purchase price.

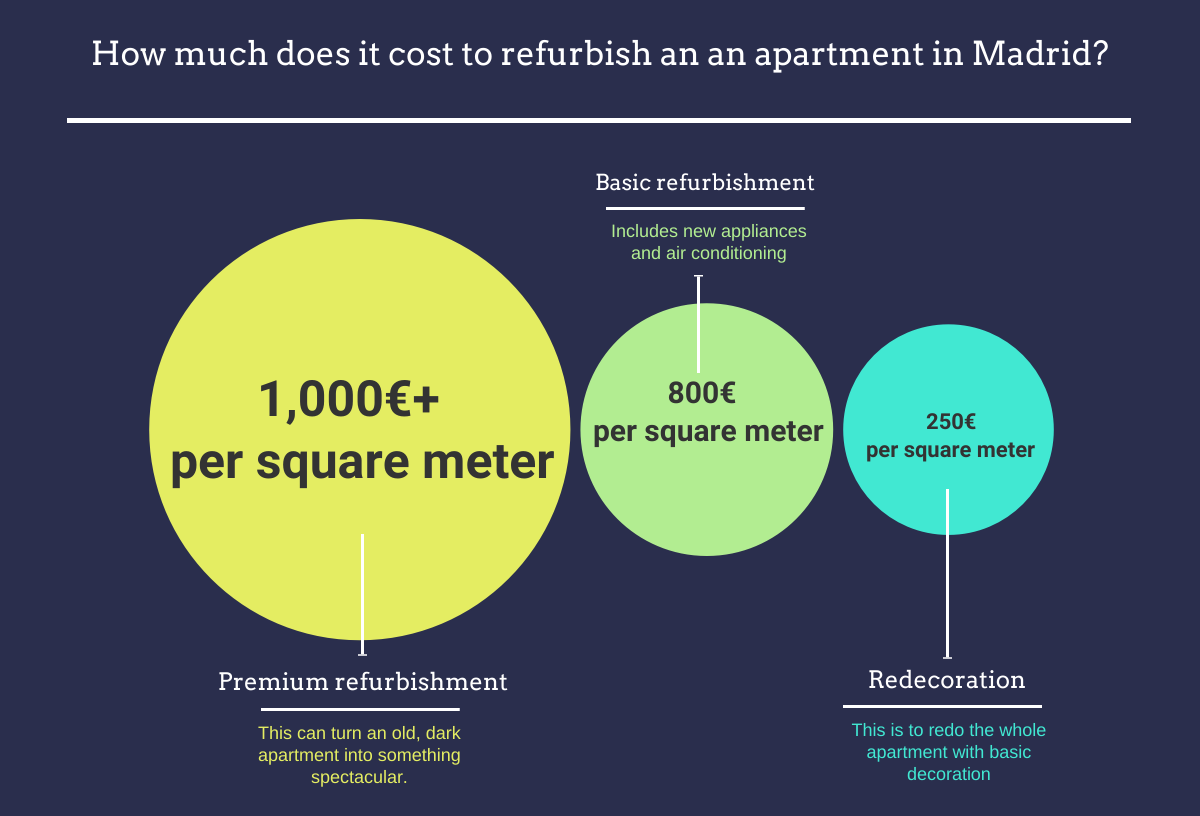

Refurbishment costs depend upon whether you want a basic refurbishment, premium refurbishment or just a redecoration. We have found that every 1€ spent on refurbishment results in a 1.5€ return, so we always recommend doing a premium refurbishment if your budget allows.

What is the difference between short and long term property rental?

Long term property rental is done on a yearly basis. You and the tenant typically sign a lease for a year, which can be extended at the end of the term.

Short term property rental is when you rent your apartment on a daily or weekly basis. This has become an increasingly popular option with the rise of Airbnb, VRBO and other online home sharing platforms.

Both long term and short term property rental have advantages.

Short term property rental advantages

- Higher yields- Moving2Madrid clients that rent their properties short term currently average 6% net returns.

- More legal rights– There is a big difference in tenant rights for short vs long term rentals. Short term rentals (anything less than a year) do not give tenants nearly as many rights as long term rentals.

- Greater flexibility- If you want to stay in your home for a few days, or even months, or invite friends to stay in your home, you can do so if it is rented short term.

Long term property rental advantages

Although returns on short term property rental are, on average, higher in the Madrid market, renting long term has the following advantages:

- Consistency- having long-term tenants means you have a guaranteed rental income for at least a year, often more. Short term vacation rentals are seasonal and can have low occupancy rates off season.

- Lower property management fees- property management fees on short term property rentals amount to 20% of the revenue generated. Since long term rentals are continually occupied by the same tenant, you don’t need to pay for basic maintenance and cleaning. Typically, you only need to pay the equivalent of one month’s rent to the agency that finds you the tenant. Moreover, you can pass utility fees on to long term tenants.

- Less administrative burden- If you rent long term, you only have to sign leases, handover keys, etc. at most once per year.

- Less wear and tear on the apartment- People tend to treat their homes much better than hotel rooms or short term vacation rentals. Therefore, if you really like your property or have high end finishing touches, it can be advantageous to rent long term.

Distinguishing characteristics like terraces, balconies and French doors really make an apartment “pop” online

Do you want to learn more about the pros and cons of short vs. long term property rental? If so, arrange a FREE CONSULTATION TODAY and one of our property search experts will walk you through the differences.

Which is better: short or long term property rental?

The answers is, it depends upon your property’s purchase price.

Properties with purchase price less than 250k€

Properties in this price range fare much better when rented long term. Typically they are relatively small without special amenities. They often cannot comfortably sleep more than two people, so don’t necessarily perform well on the Airbnb market. However, they are ideally suited for students or people recently divorced.

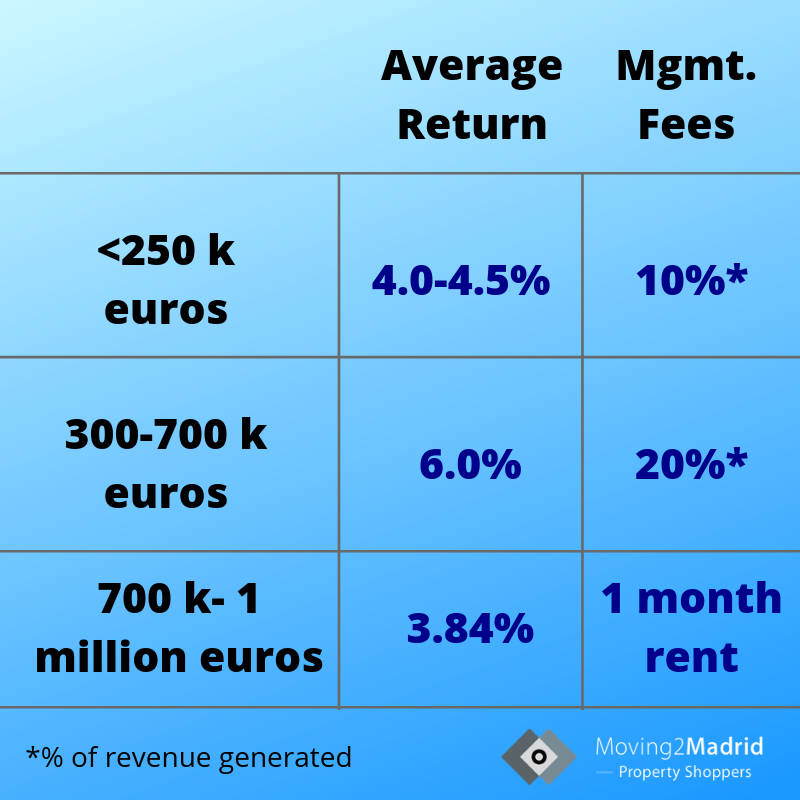

Moving2Madrid clients typically achieve a net return of 4.0-4.5% when renting their properties in this price range long term.

Properties with purchase price 300k€-700k€

In this range, Airbnb rental is still the way to go. In this price range, you can purchase a property with the features needed for them to pop up on Airbnb. These are:

- Located in the Center

- Two bedrooms

- One or two bathrooms

- Small kitchen

- Central air conditioning

- Ideally, an external entrance

The real sweet spot for short term rental is for apartments that cost 400-500k€. Moving2Madrid clients that have purchased properties in this price range are earning, on average, 6.0% rental yields.

- Small kitchens are all that is needed for short term rentals

- Queen and king size beds are often in short supply, but in high demand, in the Airbnb market

- A room that can accommodate additional guests allow families to rent your apartment

- Bathtubs and bidets are not needed for short term property rentals

Properties with purchase price 700k€-1 million€

Properties in this price range are best suited for long term property rentals. Luxury items such as large kitchens, marble countertops, bathtubs, premium bathroom fixtures and expensive furniture are not appreciated on the Airbnb market. Thus, it is hard to get an adequate occupancy rate and return to compensate one for their initial purchase price and renovation costs. Moreover, short term renters are, in general, not as considerate of your luxury items as you would like them to be. Therefore, in this price range we recommend long term rental.

Your primary cost for long term rentals in this price range will be the month commission so you have have to pay an agent to find a tenant for your property.

On average, Moving2Madrid clients that rent there properties in this price range long term earn a return of 3.84%.

Conclusion

If the all-in price of your Madrid property is between 300 and 700k€, renting the property short term is still the best option. You will have to pay 20% of your revenue in property management fees, but you can more than make up for it in the additional revenue earned.

Are you looking for the ideal property to generate passive investment income? Email us today to learn how we can help you find your ideal property.

Posted on 31 August, 2019 by Admin in Return on investment, New? Start Here

[…] your property to profit from Madrid’s very high rental yields. If the purchase price of your property is between 300-700k€, take advantage of the current “sweet spot” for Airbnb returns and rent it short term. […]