How will Brexit influence European housing prices?

Why Brexit will influence European housing prices

There are two main reasons we can expect Brexit to influence European housing prices. First, because Brexit is likely to cause many jobs to leave the UK and second, because it has caused the British pound to significantly weaken. We will take each of these in turn.

How many jobs are expected to leave the UK?

This is the crux of the issue. The answer is that no one knows for sure. Part of it will depend upon whether there will be a hard or soft Brexit. However, we have seen enough movement to know that there will be material job loss, even with a soft Brexit. It is showing up most quickly in the financial services industry. Banks that currently have their EU operations based in the City of London (or elsewhere in Britain) will need to move these operations to the EU. This is because the EU’s chief Brexit negotiator has made it very clear that when the UK leaves the single market, British financial services firms will lose their “passporting” rights. These passporting rights enable financial firms in the UK to sell their services throughout the EU. Once the passporting rights are lost, firms will have to establish subsidiaries in the EU.

A number of financial services behemoths have already announced significant job relocations. It’s not just banks- the financial services industry also includes exchanges, hedge funds, ratings agencies, technology companies that exclusively design products for, and support the financial services business, and more. To put it in perspective, according to the news source Bloomberg,

“Finance and related professional services bring in some £190 billion ($248 billion) a year, representing 12 percent of the British economy.”

We’ve already heard from a few City of London bankers that head hunters are trying to poach their top talent to work in Frankfurt and Paris. To quantify, the Bank of England has forecast that at least 75,000 financial services jobs will leave. Sadiq Khan, the Mayor of London, recently stated that a hard Brexit could cause a half a million jobs to leave.

Furthermore, job relocation will not be confined to the financial services industry. We hear about it most because it represents such a large share of the UK’s economy.

For example, in a blow to the UK’s space industry, the EU recently announced it will move its Galileo satellite system installation from the UK to Spain. This is entirely due to Brexit.

What will Brexit mean for the future of the British pound?

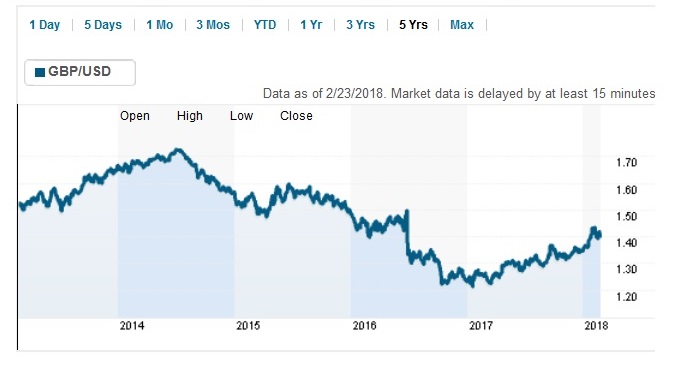

The day after the referendum, sterling dropped more than 10%. This was the biggest single-day fall for a major currency since the Second World War. It was the lowest it had been against the US dollar in 31 years. Sterling temporairly found traction against the dollar, then continued to drop. It hit a low on October 11, 2016, when a single pound cost only $1.21. This represents an 18.8% drop since the day of the Brexit referendum. It re-tested this low on January 10, 2017, at one point dropping to $1.20, but closed the day at $1.21. Since this time it has recovered, but not to its pre-Brexit levels.

The British pound dropped significant after Brexit. A cheaper pound means it is more expensive for UK citizens to buy property denominated in euros.

The future of the pound also depends upon a hard or soft Brexit. Few economists think that sterling will regain its original strength. If it does, it would likely be in the very long-term. The general consensus is that a soft Brexit will help the pound recover, while a hard Brexit would be detrimental. Although the above chart seems to indicate that the pound has regained much lost ground against the dollar, it is a bit mis-leading. This is because the dollar is weak as well.

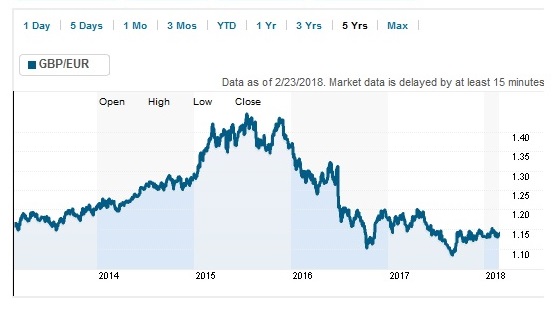

Although the pound has regained some of its strength against the euro, it still trades quite low. This is because negotiations with the EU have been rocky and relatively slow.

The pound remains weak againts the euro because many fear a hard Brexit.

What does all of this mean for UK housing prices?

UK housing prices have already tumbled. Moody’s Investors Service reported in their January 30, 2018 Brexit Monitor:

“Housing market indicators are trending below five-year averages and have fallen since the referendum. In addition, house prices fell in December and inflation is expected to moderate further in the months ahead.”

For a forecast of future housing prices, we asked an expert.

Andrew Gardiner, Founder & CEO of Property Moose

“In the UK, Brexit is already having an impact on the property market, particularly on the rental and investment sector. According to official data, net migration fell 81,000 to 246,000 in the year to March 2017. The impact of this is greatest for investment properties in tier-4 regions which are typically occupied by European migrant workers. It is likely that in the short term, property prices in these regions will decrease as demand from migrant works fades away and landlords face the reality of prolonged void periods. In the medium term, I am of the view that the price of this type of property will remain suppressed due to oversupply. As for the long-term, until Brexit has taken place, and the government’s agenda has been defined, it is difficult to forecast the impact of Brexit on UK property, and the British economy as a whole.”

What does this mean for housing prices in other European cities?

We asked a number of buying agents, located in Paris, Frankfurt, Brussels, Milan, Rome, Barcelona and Lisbon, for their predictions. Interestingly, only those based in cities where other experts think housing prices will appreciate choose to respond to our interview request.

Yulia Kozevhnikva, Real Estate Expert and Analyst for Tranio

“Brexit is already influencing property demand in Frankfurt. As one of the major financial centres in Europe, Frankfurt is benefiting from Brexit, this resulting in a substantial increase in demand for office space in the last 1.5 years. Leading lenders (such as Citigroup, JPMorgan and Standard Chartered) are planning to shift large numbers of staff from London to Frankfurt, and they require extra office space in the city. The office property market in Frankfurt has already seen some large transactions since Brexit was announced. For instance, at the end of November, Frankfurt’s largest office building Tower 185 was sold to Deka Immobilien for €775 M. Following the referendum on Brexit, Deutsche Bank has raised its average office rent increase expectations in the top segment to over 2% per year by 2020 (double what had previously been anticipated for the 2018–2020 period). The influx of office workers is also good for the city’s construction industry and residential rental market. Frankfurt has already been a hot market, and property prices and rents are expected to increase further.

British buyers are one of the largest group of cross-border property investors. However, their demand (if it changes) will not affect property prices in the world as after the UK leaves EU they still will be able to invest overseas. Although some taxes may change. For example, EU nationals pay 19% tax on buy-to-let rental income in Spain but for non-EU nationals the rate is 24%.”

Miranda Bothe, Founder of Paris Property Group

“Recently we’ve seen announcements from HSBC, Bank of America and financial institutions from the Middle East confirming they are making plans to move workers to Paris in lieu of London. The significance of this for European property prices, especially the Paris real estate market, is obvious and welcome news. These financial institutions are among a number of firms making plans to move thousands of workers to Paris. Adding that to the planned development of seven new skyscrapers in the La Defense business district, the massive expansion of the Paris metro system to form a ‘Greater Paris’ metropolitan area, and upgrades to infrastructure being developed for the upcoming 2024 Olympics, and we have the perfect storm for an expansive period of growth for Paris. Already prices are rising in the suburban areas which will benefit from the new metro lines, with a lot of new construction housing in the works. Luxury property in the historic center of Paris is also likely to benefit from the increasing number of high income professionals vying for housing.”

What does this mean for Spanish housing prices?

There are two primary reasons non-Spaniards purchase Spanish property. First, because they live, work and raise their families here. Second, because they buy second homes as either vacation homes, investment properties or some combination of the two.

Madrid housing prices

It is the opinion of this blog that Brexit will increase demand for Madrid apartments, which will put mild upward pressure on housing prices. This would result from jobs being relocated from the UK to Spain. Madrid is the third largest city in Europe (after London and Berlin) and one of Europe’s largest financial centers. It accounts for over a quarter of the Spanish economy. Thus firms that relocate their European operations are most likely to relocate to the capital city. Firms like Galileo and UBS have already announced they will be moving operations to Madrid and we expect others to follow suit.

Another factor that could increase demand for Madrid housing is Spain’s appealing Golden Visa system. If one buys Spanish property valued at 500,000€ or more, they automatically get Spanish residency, and eventually citizenship, for themselves and their family. Spain’s is arguably the best Golden Visa system in Europe. We have already had a number of inquires about this system, and property in Madrid, from City based financial services professionals worried about losing their right to work in the EU.

Finally, Madrid could see increased housing demand from people that want to own a classic apartment in an elegant European capital, but find post-Brexib Paris prices too expensive.

Spanish coastal housing prices

Currently, Brits are the largest international owners of Spanish vacation homes. We spoke with Barbara Wood, who specializes in the coastal areas of Spain, for her opinion on whether Brexit would influence housing prices.

Barbara Wood, from The Property Finders

“Roughly 60% of all transactions in Spain in 2017 happened on Spain’s Mediterranean coasts or in the Balearics and Canary Islands which, of course, are the regions where most foreign buyers head for. My experience since the Brexit referendum is [that there has been] no change to prices. The increase in demand from overseas buyers from elsewhere is more than making up for the slight fall in British buyer numbers, although Q4 stats indicate that the Brit trend is now on the up. In the best areas demand is outstripping supply so there is upward pressure on prices but that is nothing to do with Brexit and prices in prime areas have been rising since 2014. In my opinion, the slight fall off in Brit numbers is because of the weak pound and nothing to do with Brexit issues per se.

CONCLUSION

Brexit has increased European housing prices, but only in select markets. Demand and prices in Frankfurt have already risen. As companies announce plans to relocate jobs from the UK to Paris, demand is heating up in that city as well. Madrid, where the housing market is already quite strong, is likely to see an uptick in demand, but not as much as Frankfurt and Paris.

Housing demand on the coast of Spain, where a large number of Brits purchase second homes, has been slightly negatively affected by the weaker pound.

Going forward, there will likely be three main Brexit related factors that could influence European housing prices outside of Frankfurt, Paris and Madrid. These are:

- The fate of the pound. A weak pound makes it more expensive for Brits to buy property, thus dampening demand.

- Tax considerations. Currently EU citizens have to pay a 19% tax on buy-to-let rental income in Spain but for non-EU nationals the rate is 24%.” If UK citizens have to pay 24% taxes, post Brexit, this could decrease property demand.

- Working rights. If UK citizens lose the right to work in the EU, this could lead to increased demand for Spanish properties in excess of 500,000€ as they seek Golden Visas.

To take advantage of rising housing prices in Madrid, it’s important to purchase sooner rather than later. Book a free call TODAY to learn more about current Madrid pricing trends and explore your options.

Posted on 26 February, 2018 by Admin in Buy, New? Start Here

[…] rate is particularly good one day, or if you expect your home currency to fall. For example, if you live in the UK and want to buy Madrid property in spring 2019, it could be a good idea to lock in an exchange rate now in advance of Brexit related […]