Is it better to buy or rent in Madrid?

Read this article to learn whether it is better to buy or rent a property in Madrid. The answers to the question are multi-faceted, and partially depend upon your preferences.

Which have risen faster: property prices or rents?

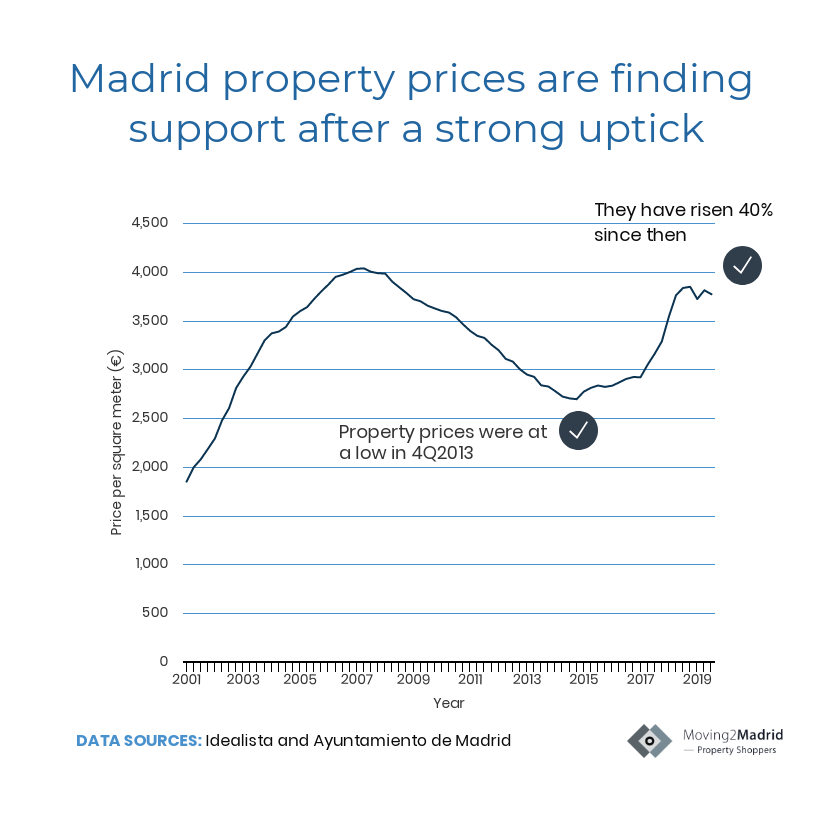

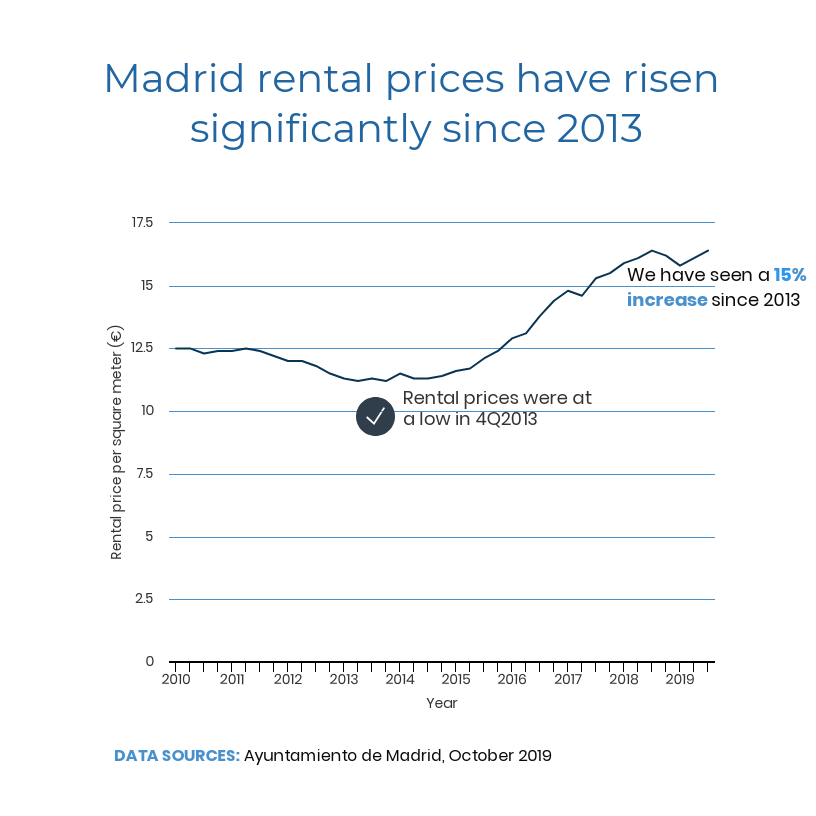

Since the 4Q2013, when both real estate prices and rents in Madrid reached post crisis lows, both property prices and rents have risen considerably. However, property prices have increased much more.

3Q2019 data demonstrates that property prices rose 40% since 4Q2013, where rents only increased 15% since 2013

Price to rent ratios

One of the primary things to look at when deciding if it is better to rent or buy are the price to rent ratios. Price to rent ratios are calculated for a given location by dividing the average property price by the average annualized rent for that location.

- If price to rent ratios are above 25, it is better to rent unless there are extenuating circumstances.

What are current price to rent ratios in Madrid?

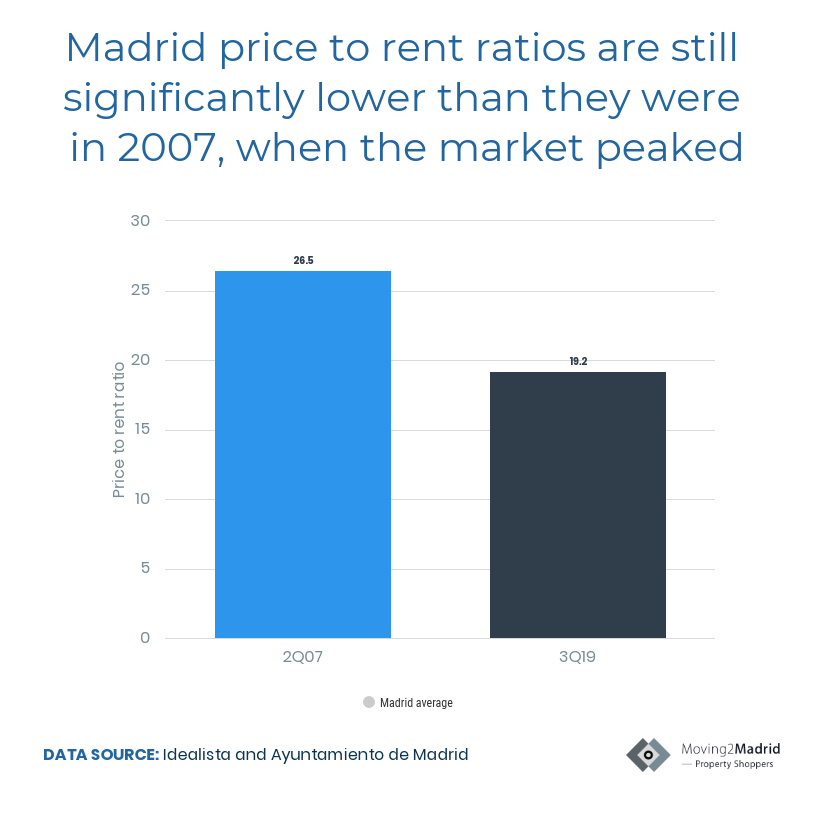

On average, the price to rent ratio in Madrid was 19.2 in 3Q19. Although this has crept up in past quarters, it is still significantly below the average price to rent ratio in 2Q07. This was the highest price to rent ratio for Madrid and signaled (for those that were watching carefully) the initial collapse of the market.

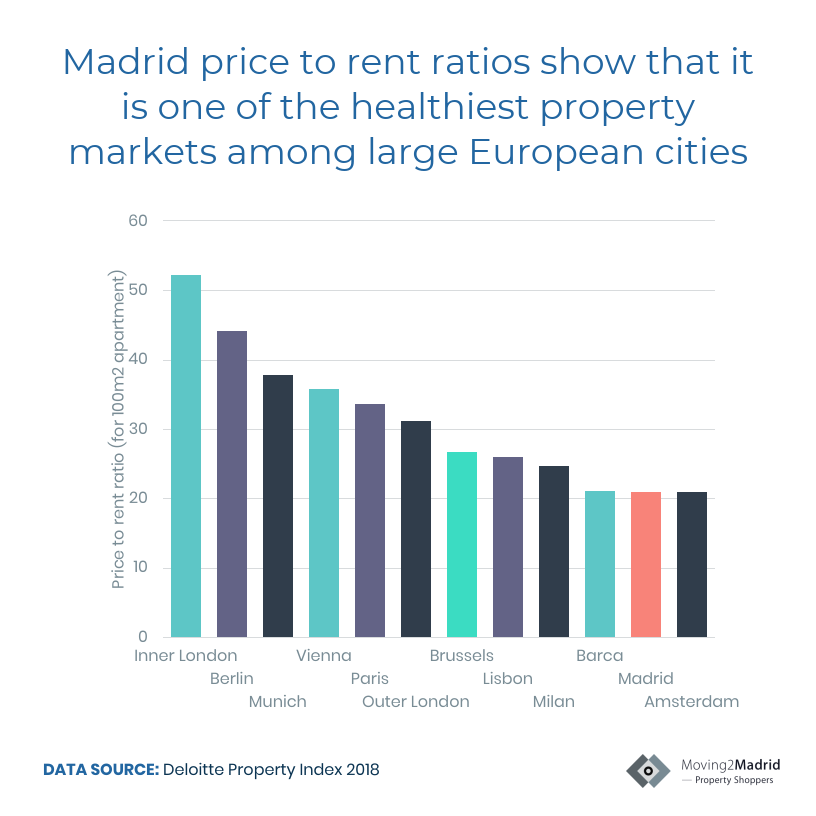

It is also worth noting that Madrid’s average price to rent ratio is much lower than that of most European capital cities. Thus, it is still a very healthy real estate market.

Do price to rent ratios vary by neighborhood?

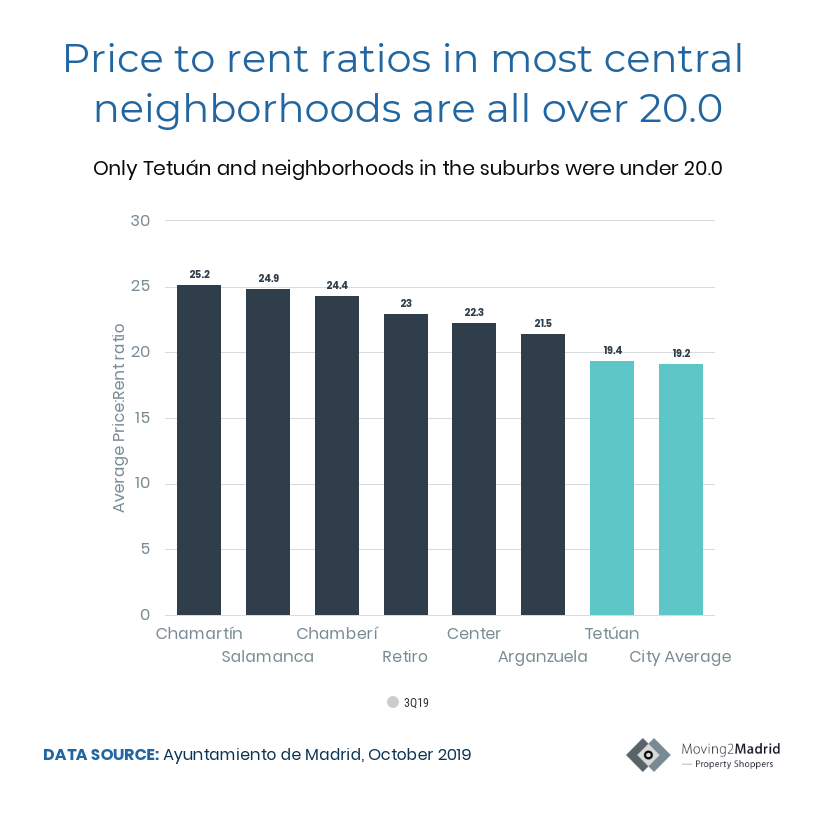

Yes, they do. Quite significantly in fact. “Blue chip” neighborhoods, such as Salamanca, Chamberí and the Center, all have price to rent ratios above 20. Up and coming neighborhoods, like Tetuán, still have price to rent ratios below 20. The same is true of neighborhoods in the suburbs.

Do you want to learn more about Madrid’s different neighborhoods? If so, contact us today and we can walk you through the pros and cons of each, based upon your situation.

Are there other things to consider, apart from price to rent ratios?

Yes. Although price to rent ratios are a great litmus test for deciding whether it is better to buy or rent, there are other things that should be taken into consideration.

Mortgage rates

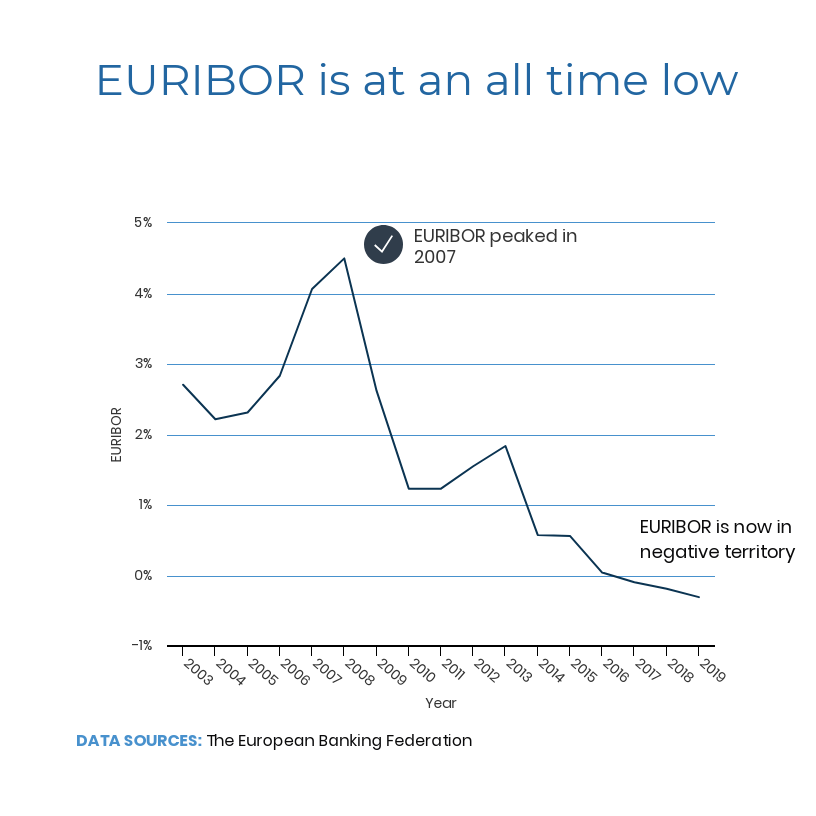

As this blog has written about before, mortgage rates are at all time lows. As of October 23, 2019, the twelve month EURIBOR was in negative territory: it was -0.288%. It is so low that we are advising our clients to get a Spanish mortgage, even if they can afford to pay cash.

Getting a cheap mortgage effectively lowers your overall purchase price, which has the effect of lowering your price to rent ratio.

In short, being able to leverage your purchase with cheap money is another excellent reason to buy, as opposed to rent.

How long you want to live there

Another key factor in determining whether it is better to buy or rent is how long you want to stay in a property. Buying a property comes with a number of fixed costs, such as paying the property taxes (IVA, stamp tax), legal and administrative fees and estate agent commissions. The longer you live in a place, the more opportunity you have to amortize these initial fixed costs.

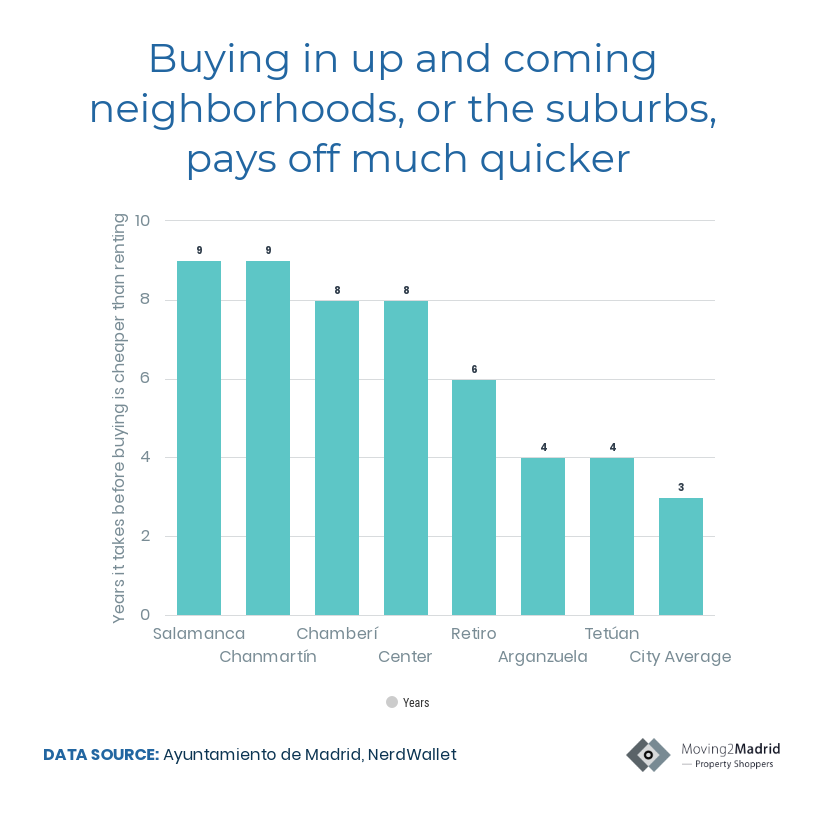

We used a reliable Rent vs. Buy calculator to calculate how long it would take one to amortize the costs of buying in established, and up and coming neighborhoods in Madrid. We also compared this with the Madrid city average.

All of our inputs were standardized, based upon what the average international buyer would obtain. These inputs were:

- 50% down payment

- Current EURIBOR + 2.0%

- 15 year term mortgage

Based upon these inputs, we found that if you plan on living in your apartment for four years or more, it makes sense to buy in up and coming neighborhoods like Arganzuela and Tetuán. If you want to live in Retiro, it is more economical to buy if you plan on living there more than six years. If you want to live in a “blue chip” neighborhood such as Chamberí or Salamanca, it can take up to nine years for you to break even when you buy rather than rent.

The opportunity cost of your property investment

Buying a property is a big decision. Anytime you make an investment this big, you should look at through the lens of its opportunity cost. This means, if you want to buy a property for 500k€, you should look at what this money could yield if you put it in other investment vehicles, such as the stock market or bonds.

When you do this, it is important to look at alternative investments with similar risk characteristics. Thus if you are buying a property in the Center of Madrid, you shouldn’t compare it to risky investments like cryptocurrency or even many stocks. Rather, you should compare it with something much safer, such as US Government bonds. Currently, US Government bonds are yielding 3% or less. The average net return on property investment for our clients is 6%. Given the difference in the returns on these two investment vehicles, from an opportunity cost perspective it makes sense to buy property in Madrid, rather than rent.

What if you are buying your property as an investment vs. to live in?

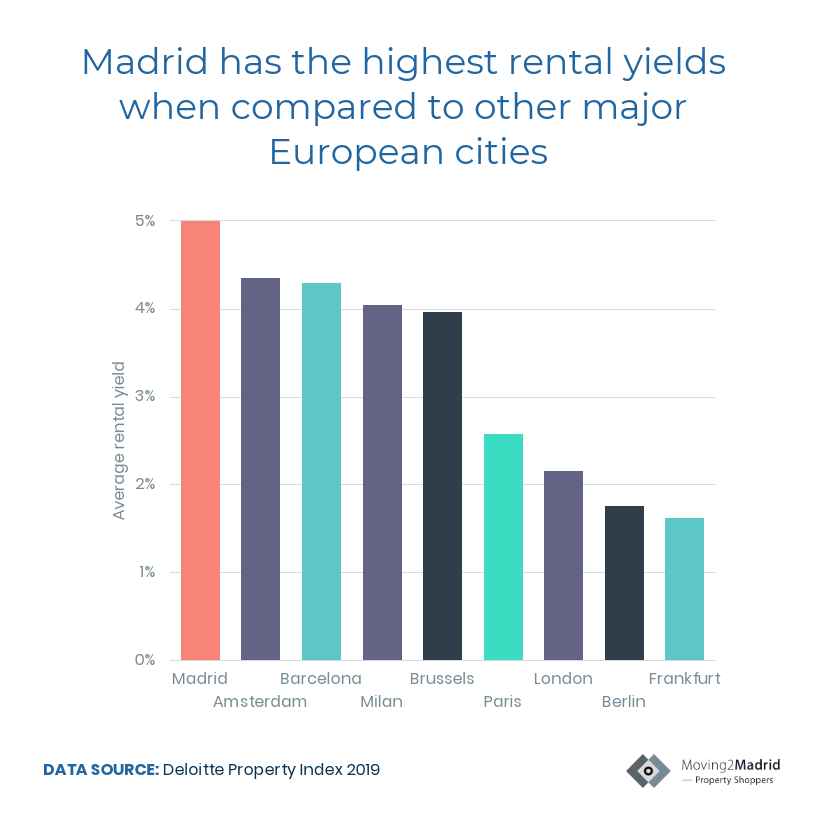

If you want to purchase a property as an investment vehicle, rather than to live in, the above arguments are not relevant because obviously, you can’t rent out an apartment that you don’t own. In this case, it is best to look at the opportunity cost of investing in Madrid real estate as opposed to other European capital cities.

In this situation you want to look at at rental yields, which are the inverse of price to rent ratios. Rental yields in Madrid are some of the highest in Europe. The following factors have contributed to their increase:

- Although property prices have risen in Madrid, they have risen even faster in key cities like Paris and Amsterdam.

- Spain’s strong GDP performance has led to an increase in the rental rates for flats in Madrid.

- Madrid’s vibrant tourism sector, and the increase in Airbnb properties, has caused rental rates to increase relatively dramatically in certain Madrid neighborhoods.

Conclusion

If you are planning to live in your property, it usually makes more sense to buy rather than rent. This is particularly true if you are planning on living in your property for more than five years. If you are planning on living in your property long term, you can even buy in a premium neighborhood and you will break even in the long term.

If you are planning on buying a property for investment purposes, buying in Madrid is still an excellent option as rental yields in Madrid are some of the highest in Europe.

Do you want to find your ideal home in Madrid? Book a FREE CONSULTATION TODAY to learn the best neighborhoods to target for your Madrid property search.

Posted on 24 October, 2019 by Admin in Costs, New? Start Here

Leave a Reply