The benefits of investing in real estate, compared to other asset classes

This article explains how real estate investing compares to other asset classes. Then, it explains how to achieve a rental yield higher than average equity market returns but with the risk profile of a bond investment.

What are the main asset classes?

An asset class is a group of investments that exhibit similar characteristics and are subject to the same laws and regulations. There are four traditional asset classes:

- Equities (stocks)

- Fixed income (bonds)

- Cash equivalents (bank deposits and money market instruments)

- Real estate

Most investment professionals now include derivatives, and even cryptocurrency, in the asset class mix. However, since these are outside the risk profiles of most of our readers, this article will focus on the four traditional asset classes and how real estate investment compares to them on a risk and return basis.

Stocks

This asset class is considered to be the riskiest of the four. However, individual stocks have a spectrum of risk profiles, ranging from penny stocks (very risky) to relatively safe blue chip stocks. The US Dow Jones Industrial Average (DJIA) is a price-weighted average of the stocks of 30 large American publicly traded companies. It is the most well-known U.S. stock index and is used to gauge the performance of blue chip stocks (companies that are industry leaders). In 2018, the DJIA’s return was -5.97%. Using a calculation including dividend reinvestment, the DJIA returned -3.48% in 2018.

Investing in Madrid real estate is a much safer bet than investing in equity markets

Investing in real estate

In general, real estate is considered the second riskiest of the four asset classes. Like equity investment, the return from real estate varies greatly. It is riskiest when investing in developing countries. Barriers to investing in real estate include a lack of transparency, low liquidity and undeveloped capital markets. Thus investors with low risk tolerance will want to stick to developed countries.

Importantly for all investors, not just those more risk averse, investing in real estate has significant diversification benefits. McKinsey looked at the returns from more than 10,000 real-estate investments across asset classes in 14 major cities over a 19-year period. They found that real estate returns tended to be inversely correlated with those of conventional assetss. Significantly, this means they serve as a good diversification play for the portfolios of most investors.

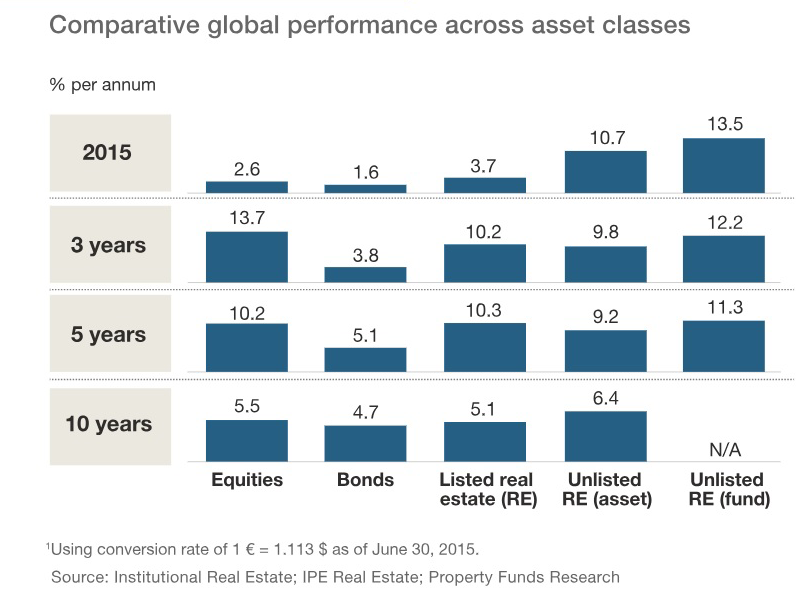

Moreover, the McKinsey study found that invsesting in listed real estate achieved returns comparable to returns achieved by equities over holding periods of three, five and ten years. And this was during the long bull market. Now that the stock markets has stabilized (as mentioned above the DJIA’s return was -5.97% in 2018), investing in real estate can attain a much higher return than investing in equities.

DATA SOURCE and GRAPHIC CREDIT: McKenzie

Do you want to invest in real estate but don’t know where to begin? Arrange a FREE CONSULTATION today and we will help you get started.

Bonds

Bonds are considered the second safest of the asset classes. Like equities and real estate, different bonds have different levels of risk.

Bonds are issued by companies and governments to raise money. Bonds provide a regular stream of income (which is normally a fixed amount paid at regular intervals) over a specific period of time, and promise to return investors their capital on a set date in the future. Investing in fixed interest securities issued by companies other than those issued or guaranteed by certain governments (for example US Treasury bonds), exposes you to greater risk of default in the repayment of the capital provided to the company or interest payments due to the fund. The value of bond investments are sensitive to changes in interest rates. That said, you can see in the above graphic that their return is still much below that of equities or real estate. Currently, US government bonds are yielding 3% or less.

Cash equivalents

Cash is the safest form of investing. Like the other asset classes, there is a range of return within the asset class. However, even the highest yielding accounts won’t fetch much more than investing in bonds.

Banks deposits are considered equivalent to cash because they have very low risk profiles and are very liquid. When you go to a bank, you can deposit your money in different types of accounts. In general, the more liquid the account, the lower return. For example, regular checking accounts are very liquid, but offer very little return. If you have low balances they can even cost you money, once you factor in the fees.

Money Market Accounts

A money market account is a type of savings account that often requires a minimum deposit, but may offer a debit card and the ability to write checks. According to Nerd Wallet (silly name but their reseach is sound), in February 2019 the 8 best money market account rates ranged between 1.85% and 2.45% annual percentage yield (APY).

High-Yield Online Savings Accounts

High-yield savings accounts are similar to money market accounts, but give you less access to your funds. Typically they do not have ATM cards and do not allow check writing. Because online banks don’t have the expense of maintaining branches, they can offer higher interest rate than traditional savings accounts. According to Nerd Wallet, in February 2019 the best high-yield online savings account rates ranged between 2.10% and 2.45% APY- very similar to money market yields.

Certificates of Deposit (CDS)

CDs are less liquid than money market or savings accounts. Typically they have a fixed term (usually one, three, or six months, or one to five years). Shorter termed CDs have lower yields than longer termed CDs. According to Nerd Wallet, in February 2019 the best CD rates for one to five year termed investment products ranged between 2.5% and 3.3% APY.

Conclusion

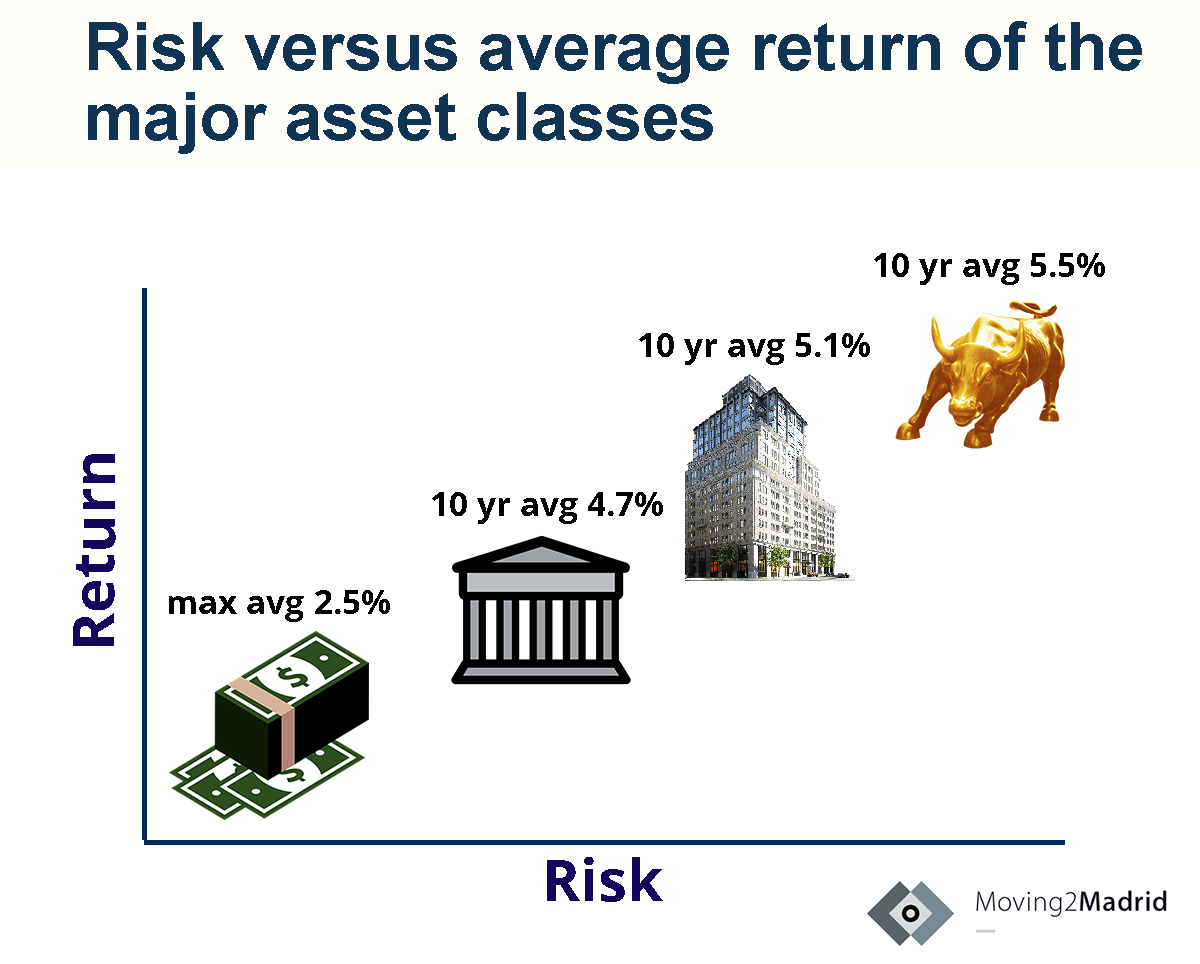

As the following chart illustrates, there is a clear trade-off between risk and return when investing in the major asset classes. That said, these return numbers are averages. Moreover, there is significant variation in the risk and return of financial instruments within these classes. Keep reading to learn how to get a return higher than that achieved in equity markets but with a lower risk profile.

A low risk, high return real estate investment

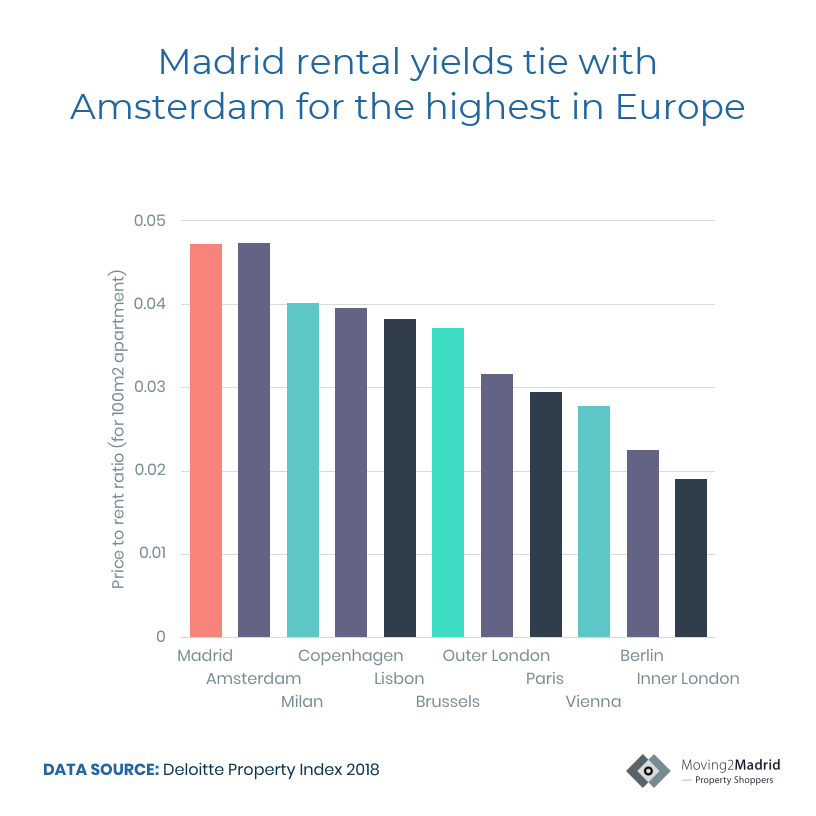

As mentioned above, barriers to investing in real estate include a lack of transparency, low liquidity and undeveloped capital markets. The Madrid real estate market has none of these problems. It is transparent, highly liquid and the Spanish capital markets are fully developed. It is often over looked by international property investors which is to your advantage because it has some of the highest rental yields in Europe.

Madrid real estate vs. real estate in other European cities

On average, the annual rental yield on Madrid real estate is 4.6%. These are some of the highest rental yields in Europe. Moreover, you will most likely benefit from property price appreciation when you decide to sell your apartment.

How to beat the average returns

Moving2Madrid clients achieve rental yields well in excess of the 4.6% Madrid market average. By following these steps:

- Invest in neighborhoods in the Center of Madrid

- Find an aparment with an apparent defect and rehab it to ameliorate this defect

- Rent it on the short term market

our clients receive returns that match, or exceed, average equity returns. Even better, these investments have risk profiles similar to bonds.

Here are three case studies demonstrating how our clients have achieved this risk/return profile by investing in Madrid real estate:

Case Study 1: Invest 250-380k€

Case Study 2: Invest 375-500k€

Case Study 3: Invest 500-850k€

Moving2Madrid clients typically earn 50-100% above the Madrid average. To learn how you can achieve these returns, which is higher than you can get keeping your money in the bank and much less risky than the stock market, CONTACT US TODAY.

Posted on 3 May, 2019 by Admin in Return on investment, New? Start Here

[…] want to buy a property for 500k€, you should look at what this money could yield if you put it in other investment vehicles, such as the stock market or […]

[…] Although gross rental yields tend to dominate real estate literature, property buyers need to focus on net rental yields. This enables you to see exactly what a property will do for you financially and enable you to benchmark your real estate investment to other asset classes. […]