How to determine if a rental property is a good investment

This article explains how to tell if a rental property is a good investment. It does this in three steps:

- It gives our favorite shortcut for getting a good deal on an apartment.

- It features a case study.

- It contains a tool to help you estimate a property’s rental yield if rented on the short-term Airbnb market.

Airbnb rentals need to be attractive, but don’t need large kitchens. This is an advantage when looking for a rental property as other buyers want large kitchens.

1–Moving2Madrid’s shortcut for rental property success

We are able to leverage our experience and expertise to help buyers turn ugly ducklings into swans.

Our strategy is to find apartments with characteristics that other buyers hate. Buyers new to the Madrid market see issues that they think are deal breakers and pass on apartments that are actually hidden gems. We know which defects are solvable and leverage them to increase returns for our buyers. These are the types of “defects” that our experience, our trained staff and our excellent network of lawyers and architects can resolve:

1-Apartments in need of refurbishment

Not many people want to take on a full apartment refurbishment, particularly if they live abroad. Therefore, many great apartments are over looked. We have helped over three hundred clients find and refurbish apartments. We know how to manage your renovation so it is stress free.

The benefits of refurbishment are simple. We have found that every additional 1€ our clients spend on refurbishment adds an additional 1.5€ to the value of their apartment.

2- Apartments with legal defects

The Madrid property market has intricacies that often scare foreign buyers. For example, debts are attached to properties, not buyers. Typically when you buy an apartment, there is a mortgage attached to it. This is common practice and it is standard procedure to get the debt cancelled during the closing process. However, many apartments have additional debts attached. These terrify buyers and the apartments have a hard time on the market.

Another scenario is an apartment that is at the center of an inheritance battle.

Our property shoppers know which types of legal defects are solvable. They identify undervalued apartments and work with our legal team to resolve the associated legal issues. Our clients are the winners.

3- Annoying sellers and estate agents

The Madrid property market is fraught with irritating people. Many clients simply don’t want to give them their money. We have learned that this attitude only hurts the buyer. Those with patience and diplomacy can end up getting a good deal on an apartment because others simply walked away. This is a situation where Moving2Madrid adds real value to our clients, because we negotiate for them. All they have to do is sign the documents.

4- Properties with structural “flaws”

Many buyers do not want to buy a property that needs to be refurbished. This is also because Spanish mortgages do not include these costs and therefore if you have the cash, you are getting better valuations than most. Another classic is a property with a sub-optimal distribution, where most normal buyers cannot visualise or professionally assess which walls can be taken down, which cannot, whereas we have been doing that repeatedly.

One of the most important things to consider is the number of windows. That is because they limit everything: the number of bedrooms, the amount of light, etc.

5- Properties in up and coming neighborhoods

Many buyers only want to buy in chic, established neighborhoods. They either want the prestige associated with them, or they don’t know the Madrid property market well enough to know which neighborhoods are appreciating in value. A great example of this is Lavapiés. On first glance, a foreign buyer might be intimidated by the street art or people selling fake handbags outside of the Metro stations. The truth is, Lavapiés is where Brooklyn was fifteen years ago. It was recently voted the coolest neighborhood in the world by Time Out Magazine. Many of our clients have recently purchased properties in Lavapiés and they are doing very well on the rental market.

Do you need help finding apartments with fixable defects? Arrange a FREE CONSULTATION with one of our property shoppers now.

2– Case study

You don’t have to find an apartment with all the defects listed above. Rather, find a short list of apartments that has one or two.

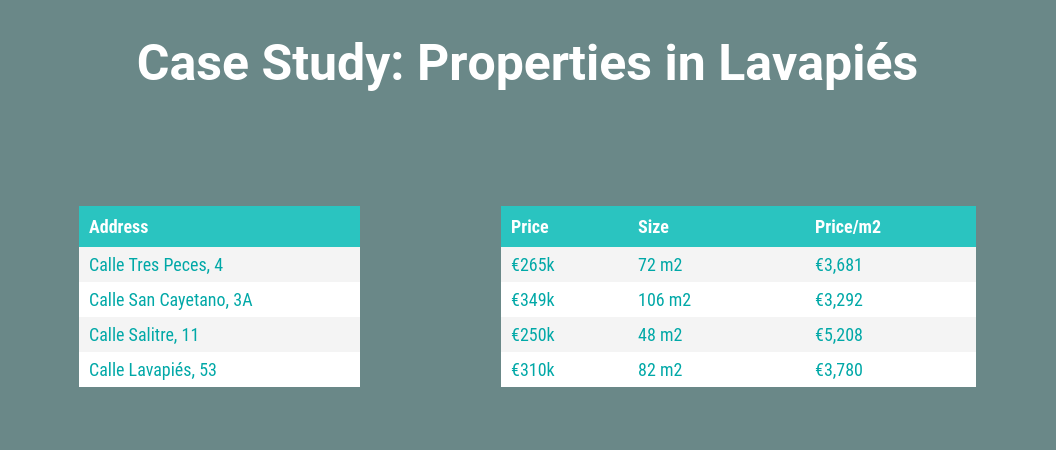

Here are four properties that have two defects: they are in the up and coming neighborhood of Lavapiés and they are all in need of refurbishment.

Once you compile a list of suitable properties, it is important to have a very clear idea of your objectives. What may be an excellent investment for one set of objectives might be less than ideal for a buyer with other priorities.

Two different buyer personas

Buyer #1: Brian

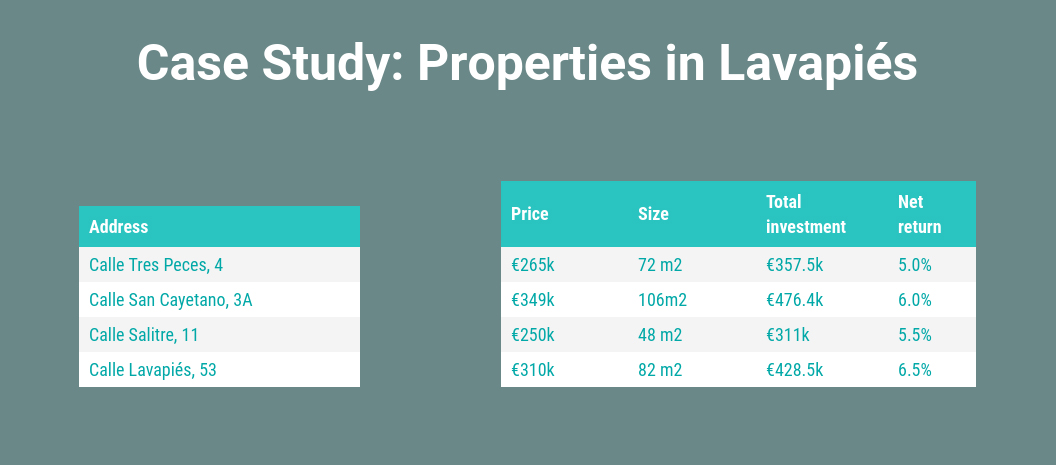

This buyer cared about only one thing: maximizing the property’s net rental yield. Therefore, we used our models and data to estimate the refurbishment costs for each apartment and the net rental yield for each apartment after the refurbishments.

Once Brian saw this data, it was easy for him to rank the apartments. His first choice was Calle Lavapiés, 53. However, as is often the case when buying an apartment, your first choice doesn’t always work out, which is why you need to make a short list.

Brian’s problem was that to get the 6.5% return, the apartment had to be converted into three bedrooms. Before refurbishment, the apartment had only two bedrooms. With only two bedrooms, the projected rental yield is much lower: it is in the 4.5-5.5% range.

Once the architect examined the building, he discovered that it wasn’t structurally possible to add a third bedroom. Therefore, for Brian the apartment at Calle Salitre, 11 was the best investment.

Buyer #2: Mary Clare

This buyer was not looking to maximize rental yield. She was looking for an apartment in which to live. Therefore, her priorities were aesthetics and quality of life. She wanted an apartment that best met the following criteria:

- Located on a quiet street.

- Had lots of light.

- Had a balcony.

- Had lots of space.

- Located in a classic building.

For Mary Clare, living on a busy street in Lavapiés was a deal breaker. Therefore, she immediately disqualified Brian’s top two choices and focused on the properties at Calle Tres Peces, 4 and Calle San Cayetano, 3A. She liked these properties because they were the cheapest per square meter.

Then, she had to prioritize her criteria. The property on Calle San Cayetano had the most light. However, it did not have a balcony and was not in an old building. On the other hand, the property on Calle Tres Peces had two balconies and was located in a beautiful old building. She decided that having a balcony in the bedroom, and windows looking into an internal courtyard, made up for the fact that Calle Tres Peces had slightly less internal light, so she chose that property.

Conclusion

As you can see, individual preferences matter a great deal when determining if a property is a good investment. Brian’s top two choices were Mary Clare’s bottom two choices. Thus you need to be very clear about your personal criteria to determine if a property is a good investment for you.

3–Benchmark its yield to comparable rental properties

Clients like Brian, that care solely about rental returns, have the best success renting their properties short-term and listing on Airbnb. Although the costs are about 20% higher because you have to pay for someone to manage the property, the incremental return is well worth it. Airbnb properties average a 60% higher rental yield than long term rental properties.

To determine if a property is a good investment, we recommend you contact us.

Moving2Madrid clients typically earn 50-100% above the Madrid average. To learn how you can achieve these returns, CONTACT US TODAY.

Posted on 4 April, 2021 by Admin in Return on investment, New? Start Here

Leave a Reply