Madrid Real Estate Report: 1st Quarter, 2018

Madrid real estate prices continued their upward trend in 1Q2018. The average price per square meter increased to 3,540€. This represents a quarter on quarter increase of 7.7% and an eyebrow raising year on year increase of 21.3%. The market did so well that the Financial Times recently wrote a piece highlighting the strong effect that international buyers and people fleeing Cataluña are having on the market. The question people are now asking is: Are we experiencing a real estate bubble?

Keep reading to learn our answer to this question, and other key developments affecting the Madrid real estate market.

Madrid Real Estate Pricing

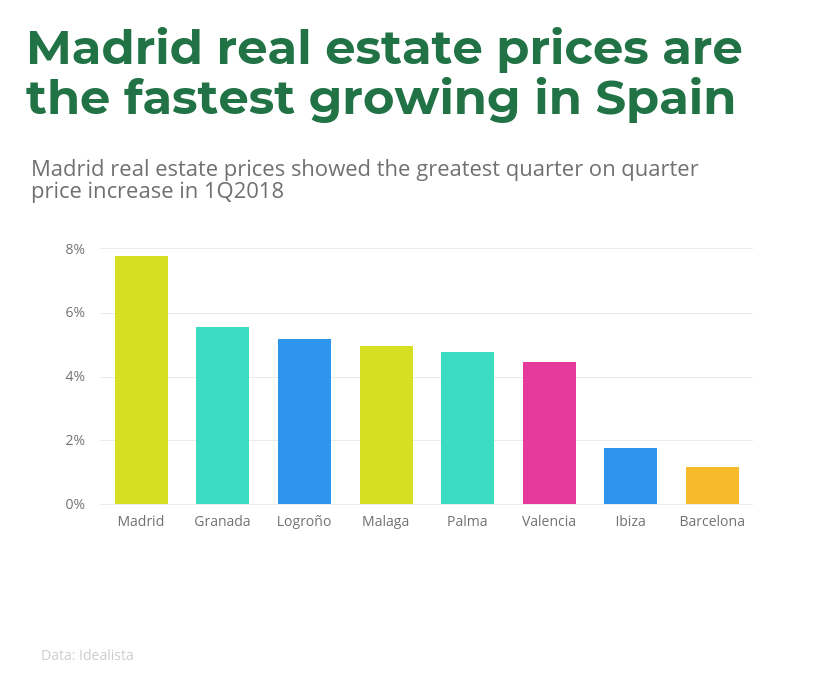

The Madrid real estate market is now the fastest growing in Spain. No other city comes close- the second fastest is Granada.

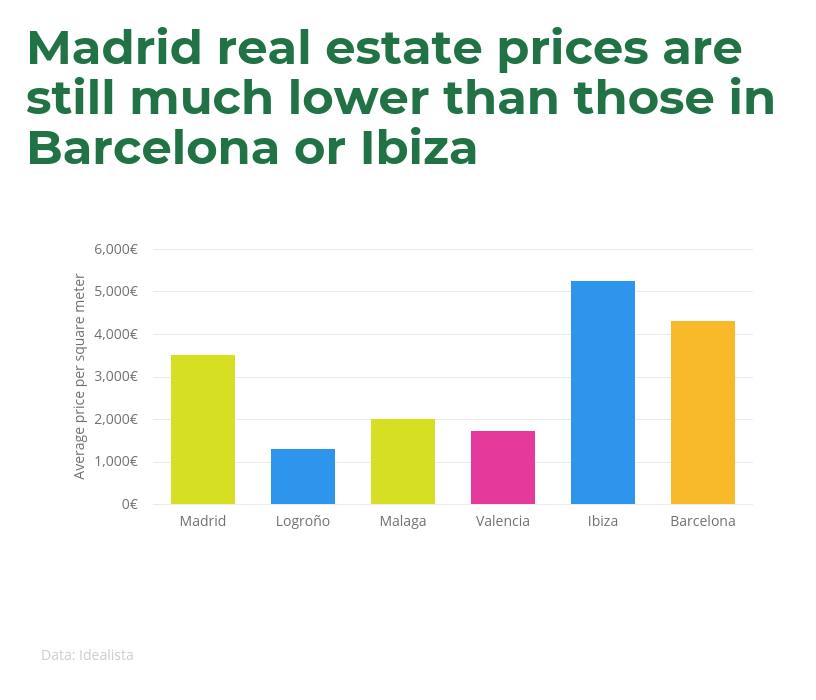

In spite of the rapid growth, average Madrid property prices are still 19% below those in Barcelona. We expect them to eventually achieve parity with Barcelona prices, and even exceed them. This is for two reasons:

- Barcelona is experiencing significant capital flight in response to the Cataluña Independence movement. At the end of December, 2017, there was only one Catalan domiciled company listed on Spain’s blue-chip Ibex 35 stock market index. When firms leave Cataluña, they take jobs with them.

- Madrid has invested heavily in infrastructure and changed laws to make the city more friendly to foreign investment. These changes filter down to the real estate market. The ITP, which is the tax on second hand property purchases, is now 6%, the lowest in Spain. In comparison, Barcelona’s ITP is 10%. Madrid has also introduced Airbnb regulation less strict and more transparent than issued by the Barcelona authorities.

Neighborhood Trends

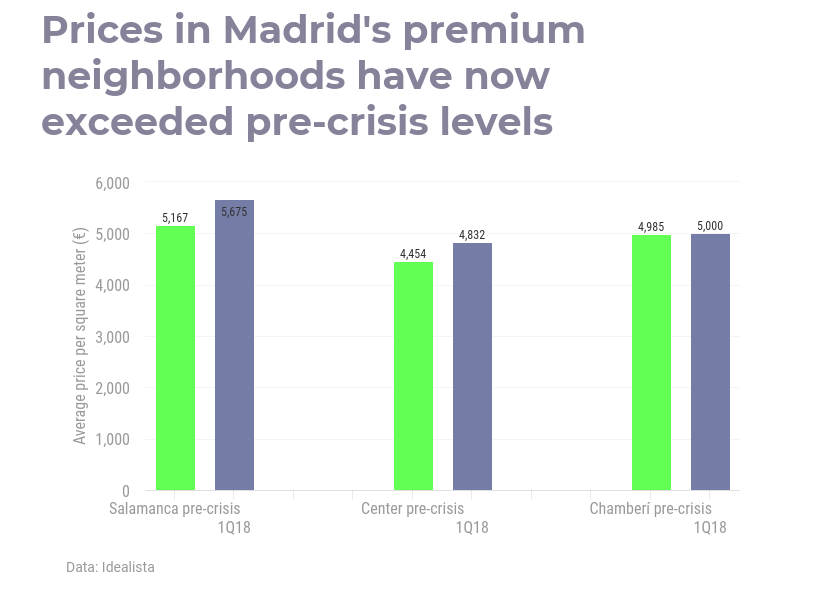

The big news is that in premium districts, such as Salamanca, the Center and Chamberí, prices have now surpassed their pre-crisis levels.

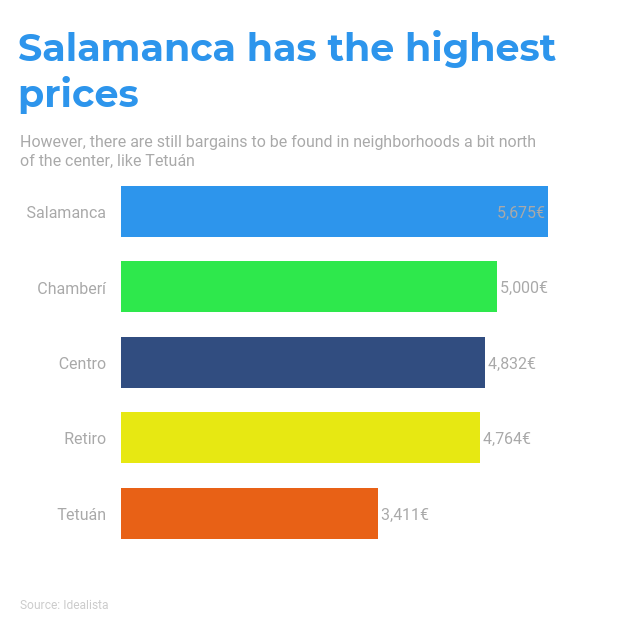

However, as we discussed in our year end 2017 Madrid Real Estate Report, there is still significant variation in pricing across neighborhoods.

Rental Yields

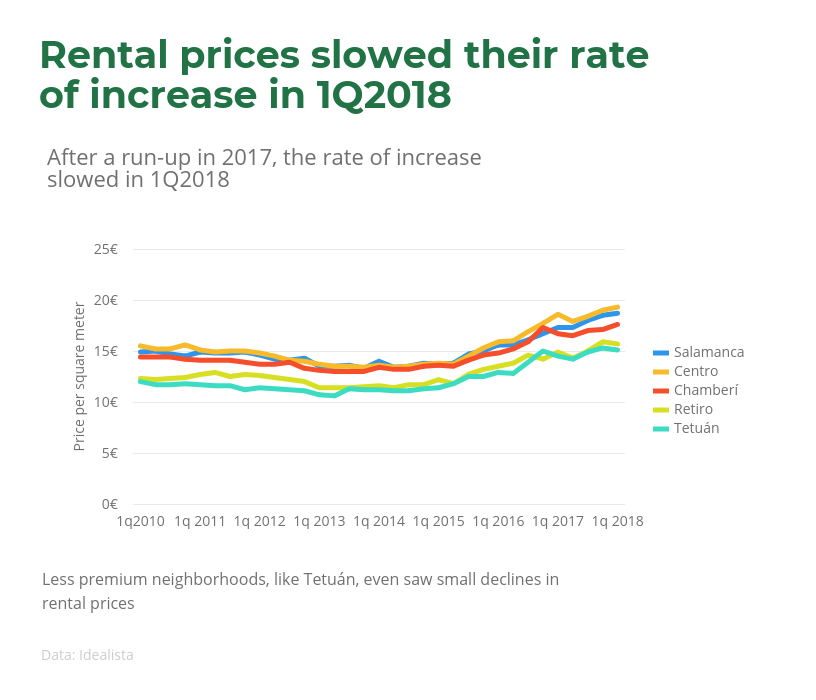

In 2017, the Spanish press was quick to criticise the run-up in Madrid rental prices, particularly in premium neighborhoods. There was much coverage about people moving out of central Madrid because rental rates had become unaffordable. In 1Q2018 we saw rental prices slow their rate of increase, perhaps signaling a reversal of this trend.

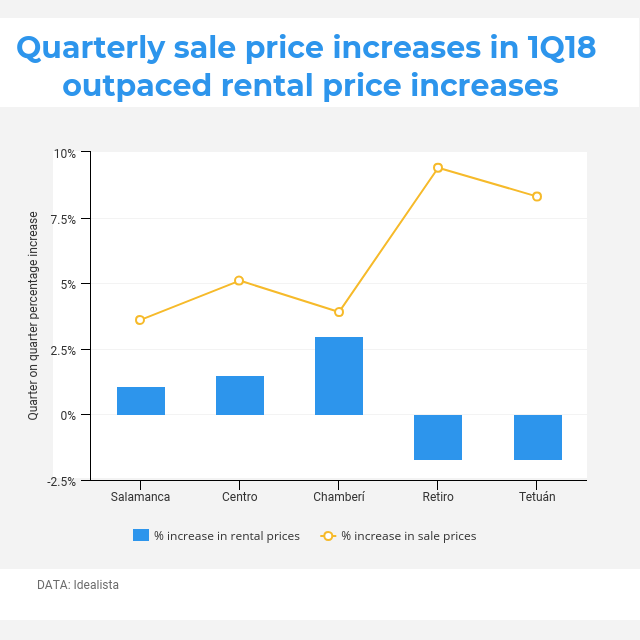

Rental yields compressing slightly?

In 1Q2018, rental prices increased more slowly than real estate prices. This was particularly true in less premium neighborhoods. Chamberí saw the smallest compression in rental yields, followed by the Center. As Madrid has some of the highest rental yields in Europe, we don’t find this particularly alarming but we will continue to monitor the quarterly data.

Are we in a real estate bubble?

Lately, we’ve received this question a lot from both clients and the Spanish media.

It’s tempting to look at a price-run and immediately jump to the conclusion that we are in a bubble. But before racing to conclusions, we think it’s important to review some basic economics. So let’s examine what an asset bubble really is, and how structural changes can permanently affect rational pricing.

What exactly is a price bubble?

Economists generally agree that the first price bubble happened in the 1600s in Holland. Tulip bulbs, imported from Constantinople, quickly started trading as luxury goods. According to CNBC and The Elliott Wave Theorist, who have done extensive research on the subject, the price of one variety of tulip bulb, the Semper Augustus, was 27.5 guilders in 1637. This represents a run-up of 27,400% when compared to the price at which the bulbs stabilized (0.10 guilders). Other bulbs are reported to have had materially larger price jumps, although reliable pricing history on these variants is difficult to obtain. Some were reputed to have cost as much as a nice house.

A more recent bubble was the Dotcom bubble, in the late 1990s/early 2000s. This bubble saw the NASDAQ (where most of the companies were listed) drop 353% as prices stabilized. Clearly, the 21% increase seen in Madrid real estate prices from 1Q2017-1Q2018 is a far cry from these recognized price bubbles.

Structural changes to Madrid real estate market

Asset bubbles happen because speculative trading causes prices of commodities to rise well above their intrinsic values. A bubble bursts when prices drop back to reflect the asset’s instrinsic value.

Structural change causes a permanent change in the instrinsic value of an asset. This blog has written about several trends that we believe are leading to a positive structural change in Madrid real estate prices:

- The City of Madrid’s Government has been streamlining regulation, lowering taxes and improving the city’s infrastructure. This is attracting foreign investment and leading to upward pressure on housing prices.

- The business exodus from Cataluña is driving many people to Madrid. We don’t foresee a resolution to this crisis.

- The British are the largest foreign investors in Spain, representing roughly 15% of investment. As Brexit looms closer, many people from the City of London are exploring owning Madrid property so they will be able to continue living and working in the EU.

- There has been a dramatic increase in the quality of Madrid real estate. According to Moving2Madrid’s CEO Pierre Waters, “Compared to other European capital cities, the prices in Madrid are still relatively low. What is different now is that the quality of the apartments has vastly improved. Ten years ago, the state of the average rental apartment in Madrid was just bad. Most apartment interiors were 20-30 years old, and sorely in need of refurbishment. Prices have had to increase to give landlords the incentive to refurbish, and bring the apartment stock to the level of a modern European capital. So yes, prices are increasing, especially in the center. But they are still quite cheap, compared with the prices in the center of other cities. People that complain about the recent price increases are taking the luxury of living in a highly walkable, capital city for granted. We’re not even close to a ‘bubble’.”

News and trends affecting Madrid real estate

- One of the major causes of the pre-crisis runup in prices, and lengthy recovery period after the crash, was the construction boom. Consensus is forming that the industry is acting with much greater restraint, post crisis. Today, the Spanish construction industry accounts for 5% of GDP, half of pre-crisis levels.

- Spanish builders appear to be learning from past mistakes. For example, some of the “ghost towns” created outside of Madrid are seeing a renewal. However, they have been rezoned to increase industrial use and cut the number of dwellings.

- The Spanish Tax Authorities are starting to crack down on short-term, illegal apartment rentals. We believe streamlined, effective regulation will continue to increase the quality of the city’s apartment stock.

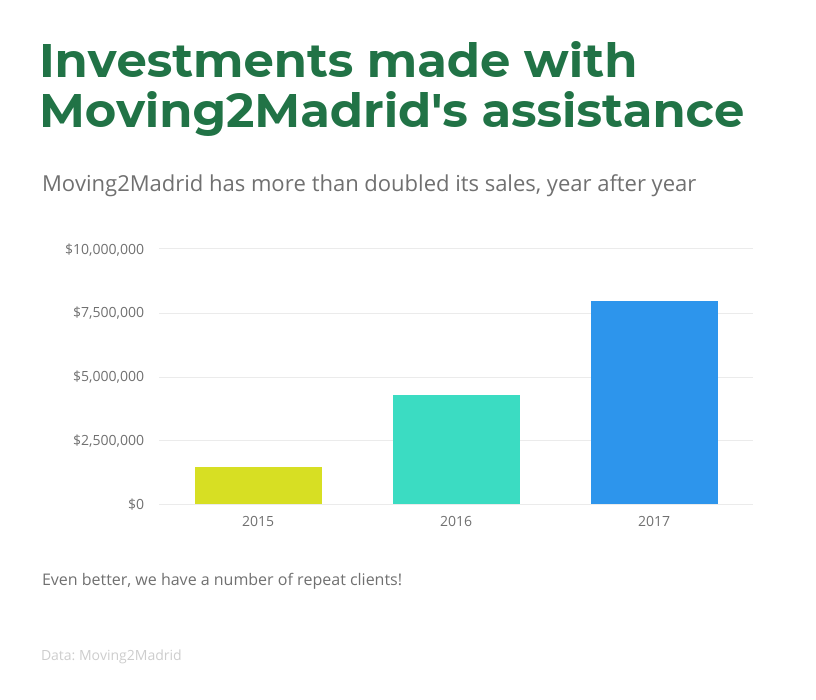

About Moving2Madrid

Moving2Madrid is a buyer’s agent that specializes in, and focuses exclusively on, Madrid real estate. We help international buyers locate, purchase, refurbish, rent and manage investment properties in Madrid. Our clients typically earn returns 50-100% above average. Arrange a free, private consultation today to learn how you can take advantage of these exciting trends in Madrid real estate.

Posted on 29 April, 2018 by Admin in Invest, New? Start Here

[…] two of the most important problems that we have in Spain today. These are two reasons why the price bubble continues to […]

[…] maintained that the country is undergoing substantial structural change, particularly in Madrid. We forecast back in January 2018 that real estate prices were not going to crash, but rather come in “for a soft […]

[…] estate market in 2017-2018, many speculated that the market was experiencing a price bubble. Our 1Q2018 Madrid Real Estate Report argued that we were not experiencing a bubble. Rather, we asserted that the Madrid market is […]

[…] we predicted in our 1Q18 Madrid Real Estate Report, Madrid property prices are getting closer to those in Barcelona. In 1Q18, average Madrid property […]

[…] prices, and lengthy recovery period after the crash, was the construction boom. We reported in our 1Q18 Madrid Real Estate Report that consensus was forming that the industry is acting with much greater restraint, post crisis. […]

[…] from future bookings. We predict that this will be excellent for the Madrid market, which still lacks high-end rentals. One of the reasons for this is that Spanish banks, unlike those in France and the UK, don’t […]