Madrid real estate report: Year end 2019

Read our 2019 Year end Madrid real estate report to see how Madrid real estate prices and rental yields performed in 2019 and see forecasts for 2020.

We discuss four topics in this report:

- Madrid real estate prices

- Pricing trends in Madrid neighborhoods

- Madrid rental market overview

- News and trends affecting Madrid real estate

Madrid real estate prices

Madrid real estate prices moved sideways in 2019, which we think is a good thing. It is a sign that the Madrid real estate market (and Spanish economy in general) is evolving.

In the past, the economy suffered strong boom and bust cycles, fueled mostly by the construction sector. If you ask most Spaniards their outlook for the real estate market, almost everyone says it is in a bubble and poised for another crash.

For the past two years, this blog has maintained that the country is undergoing substantial structural change, particularly in Madrid. We forecast back in January 2018 that real estate prices were not going to crash, but rather come in “for a soft landing.”

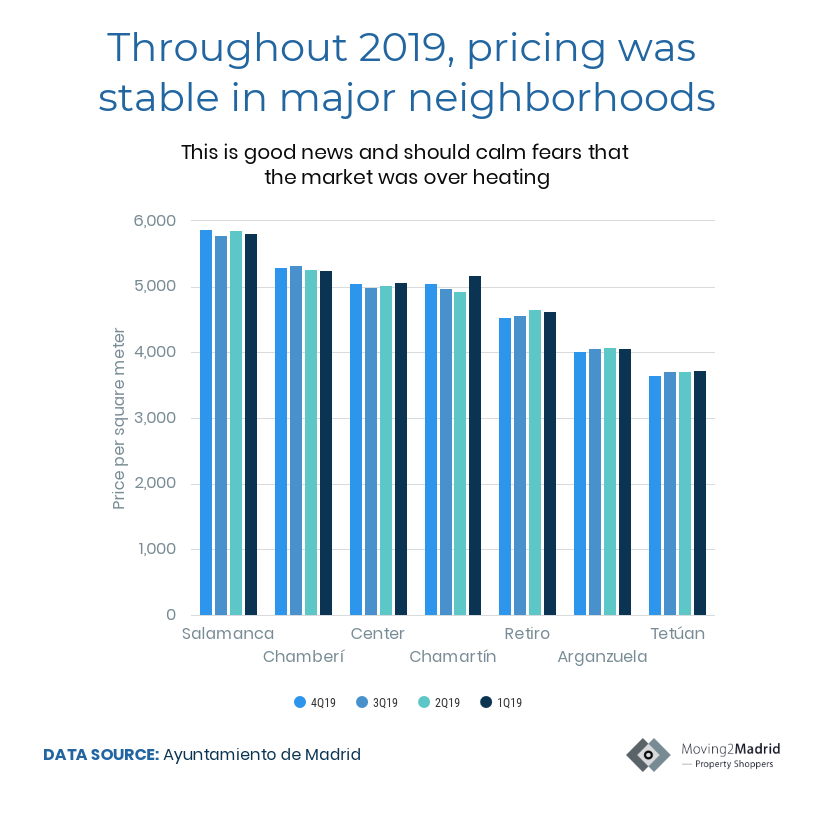

Pricing data from 2019 illustrates that our theory seems to be correct:

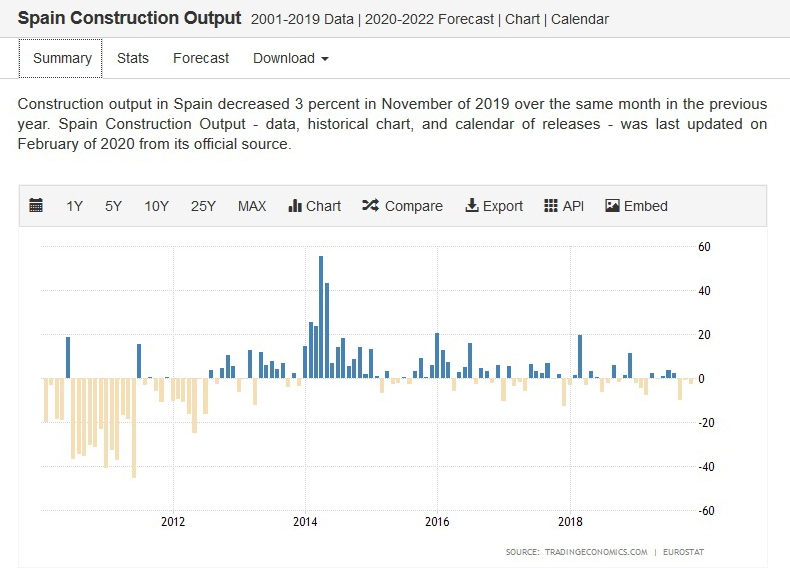

The Spanish construction sector

Spain’s construction sector represents a large proportion of Spanish GDP, compared to other European countries. In 2019 it accounted for 5.8% of GDP and employed 6.2% of all workers. Primarily, this is because home ownership is very important for Spaniards. Spain has one of the largest percentage of home owners in Europe (77% compared with 66% in the euro area).

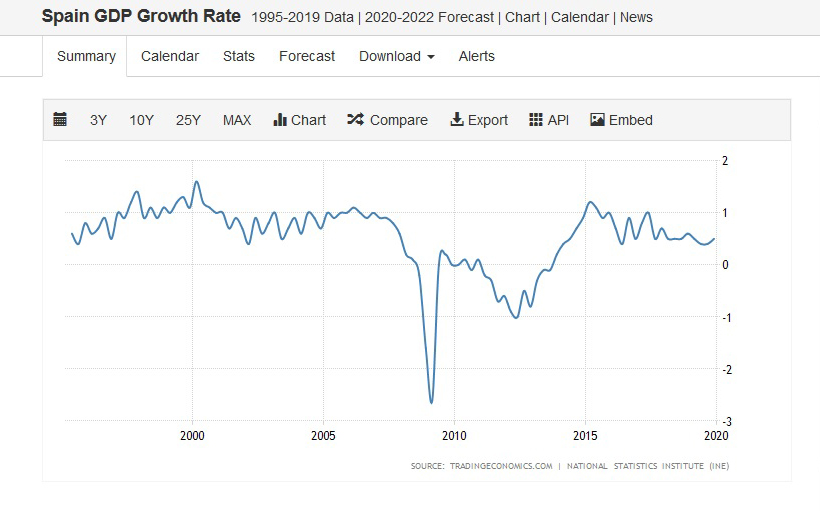

The Spanish construction industry started growing rapidly in the 1990’s and continued this trend into early 2007. When the world credit crisis hit in 2007, the Spanish economy crashed. The country was filled with giant blocks of newly built, uninhabited apartment blocks. For years, Spanish and Madrid real estate prices stagnated. The situation was so bad that Top Gear even did a feature on racing cars through an abandoned Madrid housing block.

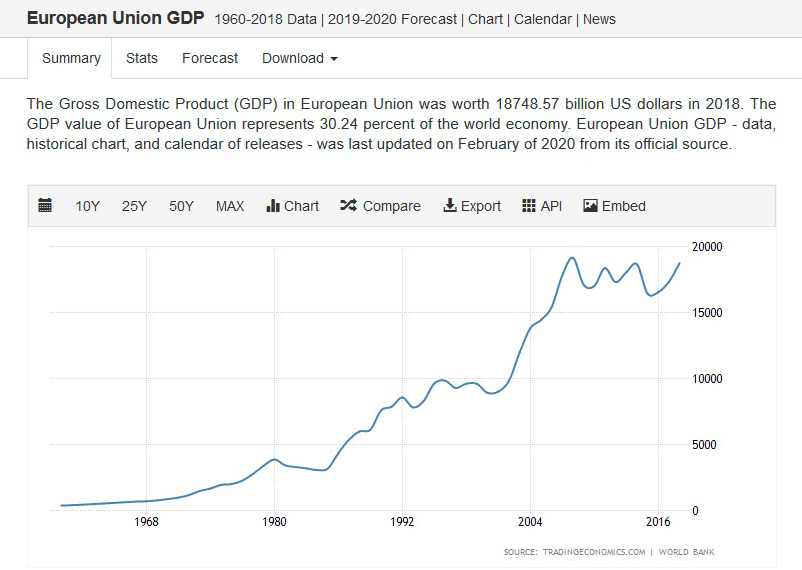

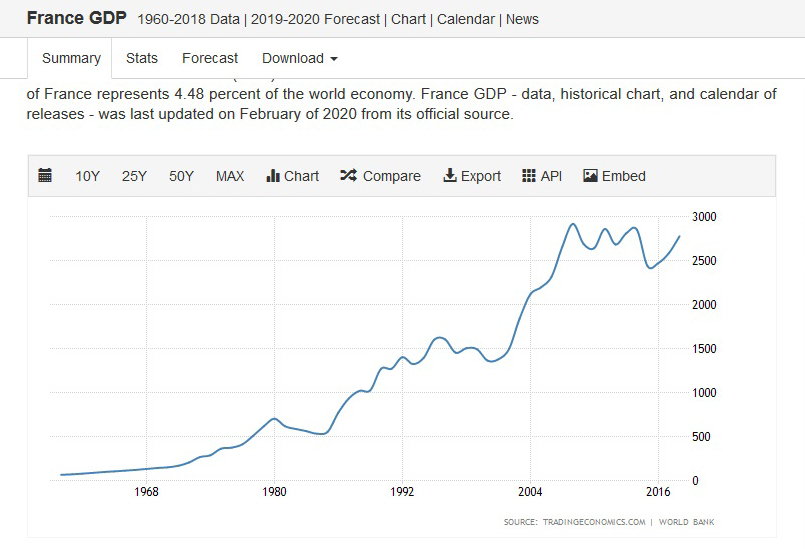

Other European countries, with smaller construction components, experienced contractions in GDP in 2007-2008, but nothing compared to what Spain underwent. You can see this in the following three charts that show Spanish, French and overall EU historical GDP data.

Where are we now?

Data shows that the construction industry appears to have learned its lesson. Although it ramped up a bit in 2014 and 2015, it showed restraint in 2018 and 2019. In 2019, Spanish construction output declined half of the months of the year. This restraint is one of the factors driving the current stabilization we see in Madrid real estate prices.

What is the outlook for Madrid real estate prices?

The Spanish economy continues to improve. The unemployment rate fell to 13.80% in 4Q19, the lowest since 2008. Consumer confidence was strong in 2019 and interest rates are still at all time lows.

The numbers look so good that Moody’s Corporation is predicting Spanish real estate prices to increase 5.5% in 2020. This is the highest growth they are forecasting for any European country. To put it in perspective, Moody’s forecasts 4.5% growth in Dutch and Irish real estate prices, 4.0% growth in German and Portuguese real estate prices, 2.5% growth in French real estate prices, 0.7% in British real estate prices and no growth at all in Italian real estate prices.

Since Madrid real estate investment accounts for over half the real estate investment in Spain, and the city continues to undergo positive structural change, we see no reason to think that the Moody’s forecasts are wrong.

Do you want to take advantage of the future appreciation in Madrid real estate prices and the high rental yields in Madrid? Then book a FREE CONSULTATION TODAY to learn how we can help.

Pricing trends in Madrid neighborhoods

Madrid rental market overview

Rental prices in Madrid

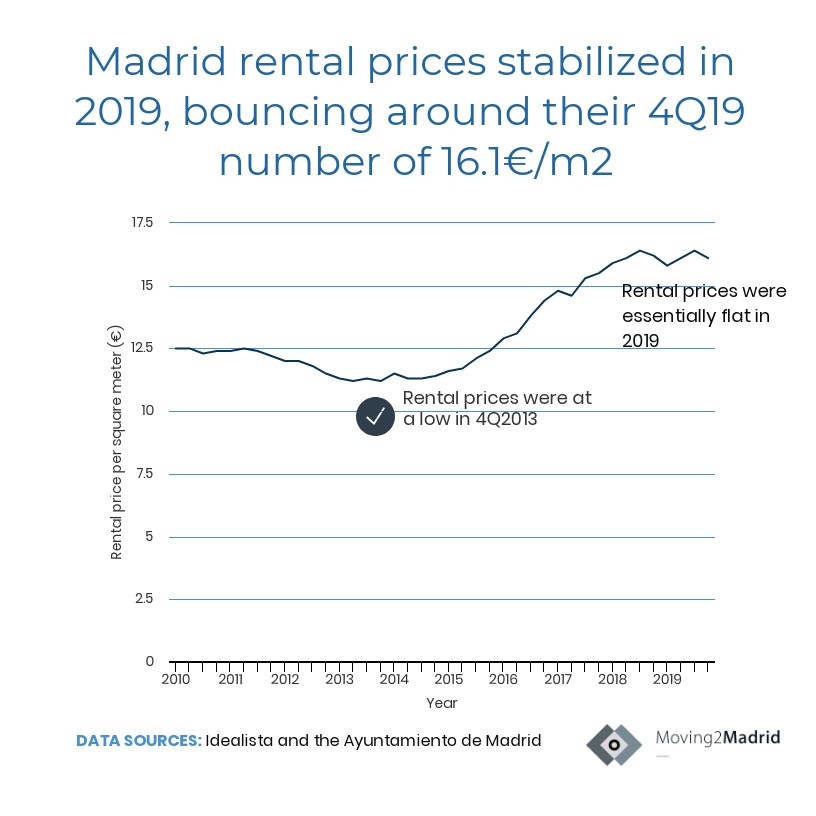

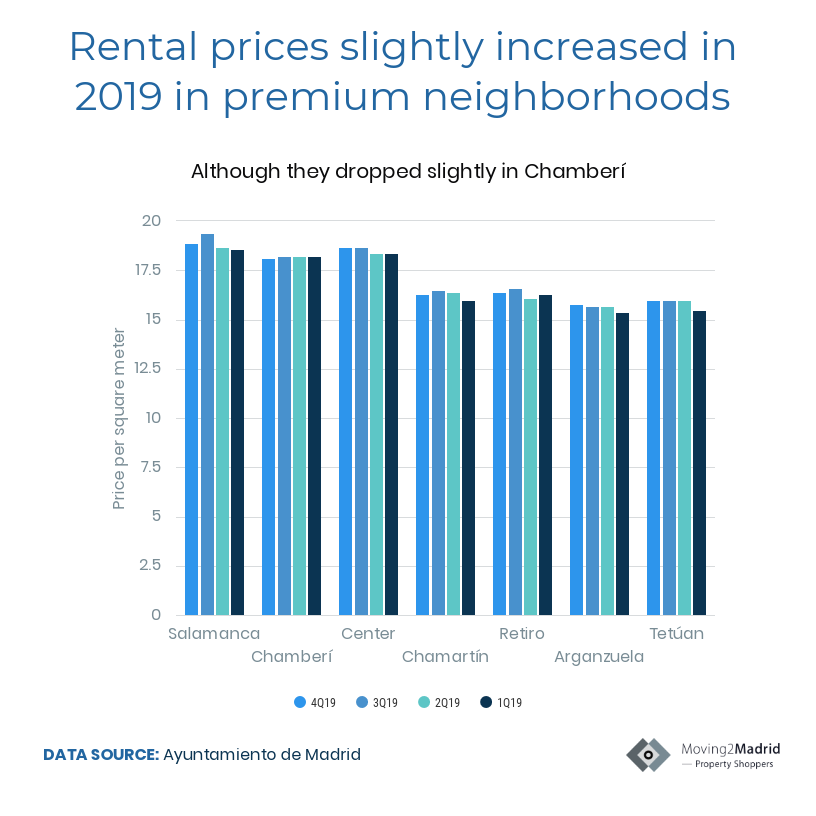

There is a lot of talk in the Spanish press that rental prices in Madrid continue to increase. This is rumored to be driven by Airbnb and short term property rentals in the city center. However, the data does not support this. Data from 2019 shows that rental prices, like Madrid property prices, stabilized in 2019.

Some premium neighborhoods, like the Center and Salamanca, saw small increases in rental prices. This was also true in select up and coming neighborhoods like Arganzuela.

Rental yields in Madrid

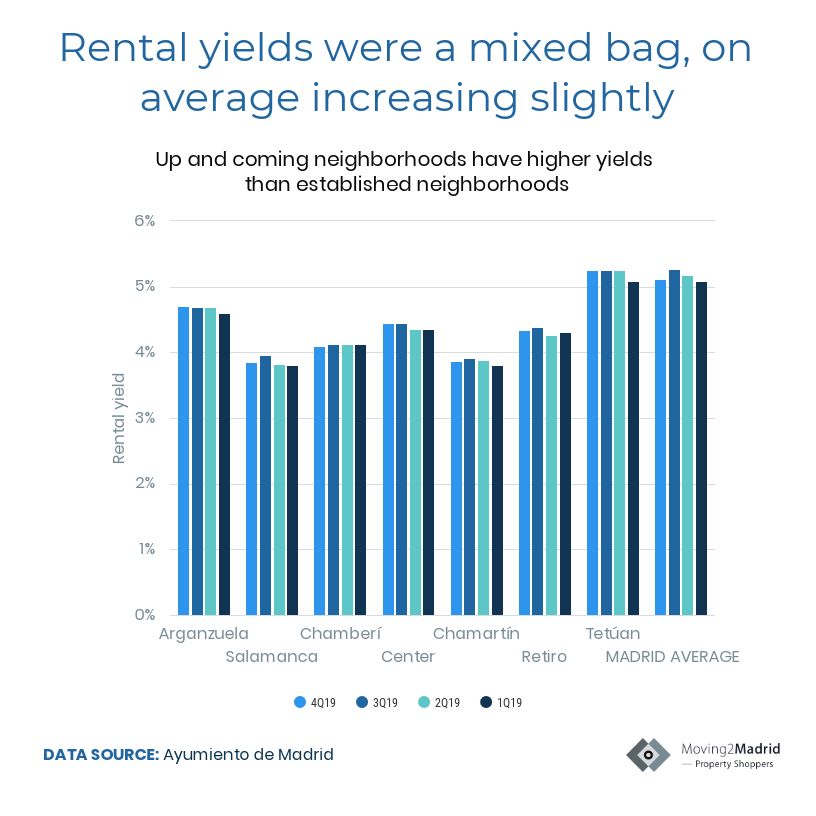

On average, rental yields moved around a bit in 2019 but finished the year almost exactly where they were in 1Q19.

On a neighborhood basis, they increased slightly in the up and coming neighborhoods of Tetuán, Arganzuela and Retiro. They also increased slightly in the Center.

News and trends affecting Madrid real estate

Forecast changes in mortgage terms and structure

As mentioned above, Moody’s is forecasting a 5.5% increase in Spanish real estate prices in 2020. The next highest is the 4.5% increase they are forecasting for real estate prices in the Netherlands and Ireland.

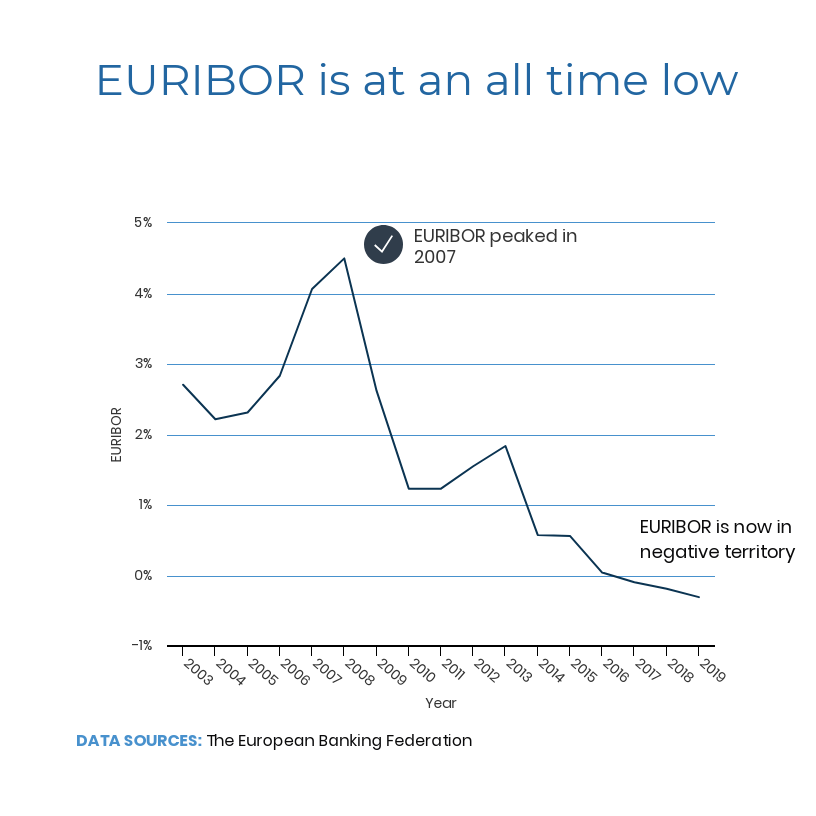

One of the main drivers for this, as quoted in Moody’s research, is “the increase in longer term, fixed rate mortgages in both Spain and the Netherlands. This, combined with the historical low EURIBOR rates, is credit positive for both countries.”

Meaning . . . if consumers can lock in very low interest payments for longer terms, this gives them much more certainty when forecasting their budgets. Fixed rate mortgages are much less risky for consumers. This, combined with lower monthly payments from longer term mortgages means they are more likely to leverage up. Increased leverage leads to increased real estate sales.

Cheaper European mortgage rates are attracting more US buyers

Mortgage rates in Europe are much lower than the US. In September, 2019, the European Central Bank reported average rates in September for eurozone mortgages with fixed terms of over 10 years at 1.44%. In the US, the average rate in September for 15 year mortgages was 3.12%.

According to a report by The Wall Street Journal, this difference in mortgage rates is attracting more US buyers to purchase property in European countries- primarily Spain, France and Italy. European mortgage brokers quoted in the article state that over half their clients are American.

Conclusion

An interesting quote in the above Wall Street article is from Kevin Monger, a Spanish based mortgage broker,

“[I have] recently found American buyers 20 to 25 year loans with a 1.75% fixed rate.”

This backs up the logic in the Moody’s forecasts of longer, fixed term mortgages fueling Madrid real estate prices in 2020, with the added kick of the market attracting more US buyers.

Are you interested in learning more about how people from other countries can get Spanish mortgages? If so, you can read: How to get a Spanish mortgage as a foreign buyer. Or, if you would like someone to explain the process to you, don’t hesitate to arrange a FREE CONSULTATION TODAY.

Posted on 4 February, 2020 by Admin in Invest, New? Start Here

[…] a strong performance in 2017 and 2018, the Madrid real estate market moved sideways for most of 2020. At the beginning of 2020, the question on everyone’s minds is: Where are we headed? Is the […]

[…] will find on our site details on current rental and property prices in Madrid and the real cost of purchasing property in […]